JEFFERSON CITY, Mo. — Missourians could get a break on state income taxes under a proposal approved by the Republican-led state Senate on Wednesday.

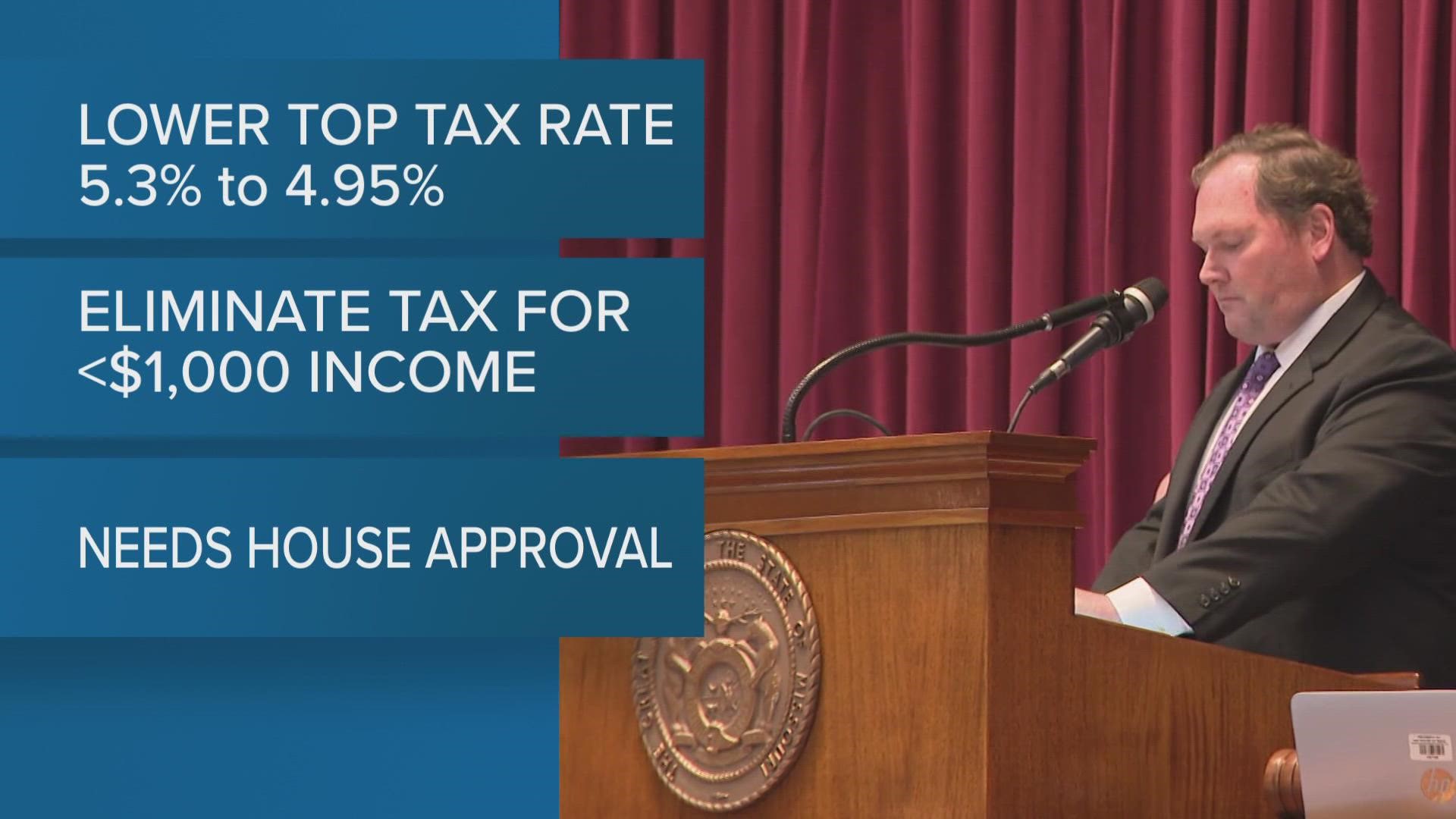

Senators voted 24-4 to send the bill to the GOP-led House for consideration.

The roughly $1 billion proposal would cut the top income tax rate from 5.3% to 4.95% beginning in 2023. Most Missouri earners pay the top income tax rate, which applies to those who make more than about $8,700 a year in taxable income.

The measure also eliminates the lowest tax bracket, meaning earners who bring in less than about $1,000 a year no longer will have to pay state income taxes.

Lawmakers returned to work last week in response to Republican Gov. Mike Parson's call for a special session to cut taxes. He proposed an income tax cut as a way of spending some of the state's record budget surplus.

Parson directed lawmakers to slash income taxes to 4.8%, as well as to increase the standard deduction by $2,000 for single filers and $4,000 for couples.

The Senate proposal represents a compromise between cautious Republican lawmakers concerned about the state's ability to pay its bills long-term and those eager to slash taxes even more deeply.

Disagreements over how much to cut continued for months as lawmakers worked to build consensus behind the scenes. Parson had called on lawmakers to return to the Capitol on Sept. 6, but they pushed back work to continue private talks.

On Wednesday, both Republican and Democratic senators described the compromise as "reasonable."

“A special session is probably not the best time to engage in a dramatic rewrite of the tax code," Republican Senate Majority Leader Caleb Rowden said, adding that more work could be done when lawmakers return for their regular session in January. "We did some good things in this bill, but we also didn't dramatically upend anything.”

Democratic Minority Leader John Rizzo said he's glad the Senate “did not go as far or as fast as the governor wanted to go in reducing revenue."

Groups including the Missouri NAACP and the Missouri Budget Project, which analyzes how state economic policy impacts low-income residents, criticized the tax cuts as primarily benefitting the wealthy while spending money that could be used for health care, education and higher pay for state workers.

“It benefits the wealthy while leaving behind the working class and most vulnerable populations,” Missouri NAACP President Rod Chapel said in a statement. “Our women and children, blue collar workers, government employees, Black citizens and other minorities are once again ignored in this quest to aid the wealthy.”

Democratic House Minority Leader Crystal Quade warned that the income tax cut will have "devastating long-term consequences for Missouri government.”

Republican Sen. Lincoln Hough, who sponsored the Senate bill, said the tax cuts in total will cost about $950 million in lost state revenue once fully implemented.

The state is slated to lose some of that revenue anyway, according to a cost estimate by legislative researchers.

Under existing Missouri law, earners will get gradual income tax breaks until the top rate reaches 4.8% if the state continues meeting revenue growth goals.

Hough's proposal would accelerate those tax rate reductions and allow the rate to drop even lower over time. Factoring in expected losses under the current projected tax cuts, legislative researchers estimated the bill will cost about another $370 million per year.