ST. LOUIS — As we approach the end of the year, it may be time to look at your money a little more closely — from taxes to deductions to donations.

2021 has once again been a tough year on so many people, so 5 On Your Side asked two financial experts for some of their best tips to maximize your money.

We asked financial planner Jeff Sachs of Sachs Financial and tax manager Rebekah Tucker from Anders CPAs + Advisors for help. Both are St. Louis-based.

Tucker is all about maximizing your refund and minimizing the taxes you'll owe in 2022.

"I would definitely make sure that you are taking full advantage of what you're eligible for," said Tucker. "Things like education credits." The IRS has a frequently asked questions page on all education credits here.

An education credit helps with the cost of higher education by lowering the tax owed on your return. If the credit reduces your tax to less than zero, you could get a refund. The two education credits available are the American opportunity tax credit (AOTC) and the lifetime learning credit (LLC).

There are also earned income tax credits (EITC). The EITC helps low-to-moderate-income workers and families get a tax break, and you can use the credit to reduce the taxes you owe. It could also increase your refund.

Find out what to do if you received a letter from the IRS about an EITC.

"If your income is at a certain level, you can take advantage of these credits," said Tucker.

Also, there are charitable donations. Something to know this year is you can deduct up to $600 in cash to a charity — usually that amount is lower.

"If you can make a little bit of a contribution to a charity that you care about, not only are you able to take a little bit of a deduction, you're also able to help out those charities because they're in need, right?" said Jeff Sachs of Sachs Financial.

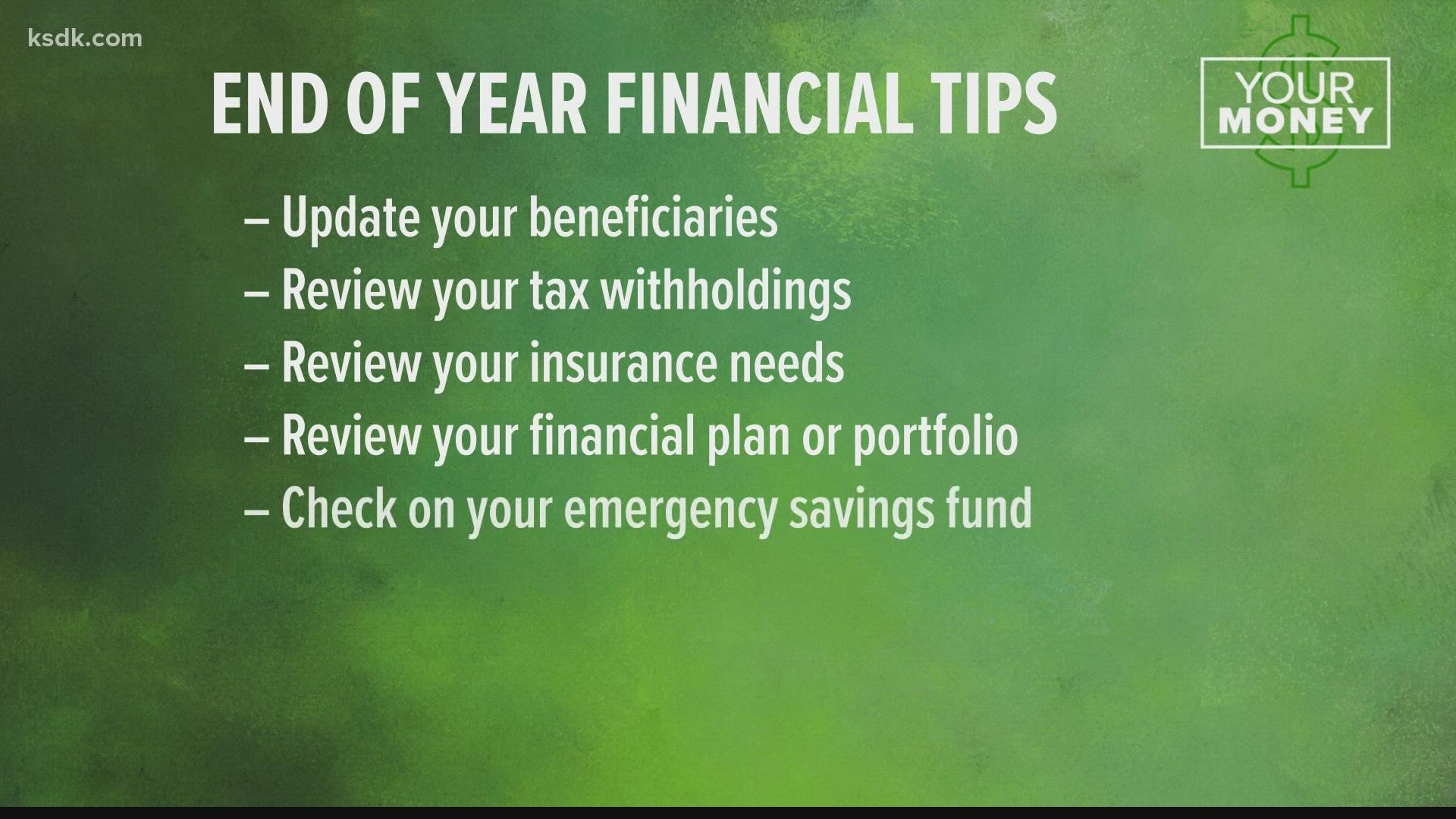

As a financial planner, Sachs recommended these five tips to end the year:

- Update your beneficiaries

- Review your tax withholdings on your paycheck

- Review your insurance needs (from your car to your house)

- Review your financial plan or portfolio

- Check on your emergency savings fund

The rule of thumb is to have roughly three to six months of expenses saved in an emergency savings fund. As big bills like real estate taxes come due at the end of the year, making changes now could set you up for the new year.

"All of those bills come due at the end of the year so it's on the top of your mind," said Sachs. "How much did I just pay for my homeowner's insurance? How much were my real estate taxes? Let's look at that again right now — that's why it comes up."

And Sachs said even people who don't have extra money right now can still find ways to make a positive impact on their finances. He said there is a lot of importance to budgeting and knowing how every dollar is spent. That might determine what you can start putting into savings or paying off debt.

If you have a money-related topic or question you'd like us to cover, send Michelle Li an email: mli@ksdk.com.