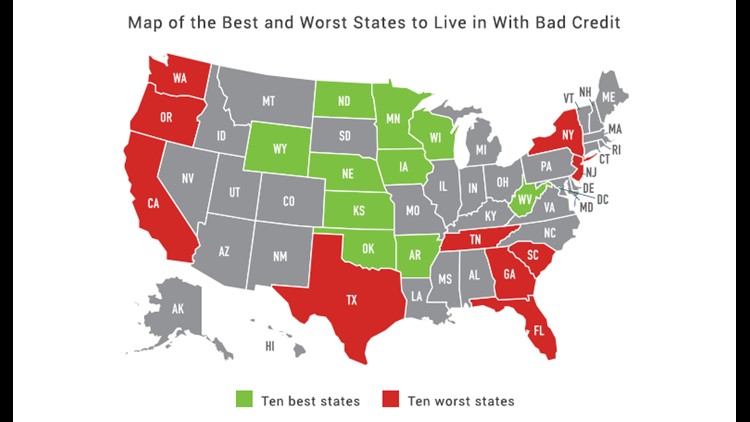

What's worse than a bad credit score? Having bad credit and living in a state where bad credit makes life even more difficult.

RewardExpert, a rewards optimization site, compared factors such as cost of living, usury laws, and the overall financial health of a state to determine how bad credit affects life in each state. Their findings suggest that you avoid the following states if your credit is substandard.

1. Washington – High prices in all categories and poor protections against predatory lending practices make Washington the most difficult state for consumers with bad credit.

2. Tennessee – The Volunteer State combines a high maximum allowable usury rate and poor rankings in all other categories to earn the status of second-worst state for residents with poor credit.

3. South Carolina – Prices are generally high in South Carolina, with housing and educational costs among the highest in the nation (41st and 43rd, respectively). There are few debt collection agencies, but that's offset by poor protection against predatory lenders. It only takes one debt collector to make your life miserable.

4. Georgia – Georgia has 267 debt collection agencies and 866 complaints per capita reported to the Consumer Financial Protection Bureau (CFPB) – third only to Delaware (895) and Washington, DC (1210). With high maximum usury rates and one of the lowest average credit scores in the nation, Georgia's debt collectors are likely to stay busy.

5. Florida – Things aren't much better across the Florida/Georgia line. High housing costs, high delinquency rates, and poor protection for consumers make Florida a difficult place for the credit-challenged.

6. New York – New York's high maximum usury interest rate (16%) and high cost of living pose a major hurdle for consumers with bad credit.

7. Texas – Texans don't do anything halfway. That includes a high cost of living relative to average income, and the large number of debt collectors ready to pounce on your unpaid debt.

8. Oregon – Oregon has a high cost of living and some disturbing trends – more debt collectors, rising housing costs, and a high number of CFPB complaints.

9. California – California leads the nation in average mortgage debt, as the state's housing prices are second in the nation – and California's number of debt collectors is second only to North Carolina.

10. New Jersey – New Jersey cracks the top ten in high cost-of-living and has the eighth highest number of complaints per capita with the CFPB. At least New Jersey has one of the highest average salary among the states at $99,026, topped only by Connecticut ($99,992) and Washington, DC ($107,594).

If you live in one of these states, what should you do? You could try moving to one of the ten best states for bad credit – or you could address your bad credit score head on.

Start by getting a copy of your credit score and examining it thoroughly for mistakes or any signs of identity theft. Correct any mistakes as soon as possible.

Assuming you've actually earned your bad credit score, you must take steps to reverse course. Pay all your bills on time and trim your expenses to create a monthly surplus. Use the surplus to pay down debt and decrease your interest charges. It's especially important to control spending when your area has a high cost of living.

It will take time and discipline to raise your credit score, but your hard work will pay off in the end. Besides, improving your credit score is a far better alternative than moving. Bad habits will simply move along with you.

This article was provided by our partners at moneytips.com.

To Read More From MoneyTips: