ST. LOUIS — Stimulus checks are on the way or already in the bank for millions of people.

Some Americans saw the money automatically go into their bank accounts weeks ago. Others are still waiting for their money.

The average person is getting $1,200, but payments can go up to $2,400.

5 On Your Side already has received a lot of questions about who qualifies for the coronavirus stimulus checks, how much people can expect and what to do to make sure you get a check. That’s why we’ve teamed up with the experts at St. Louis accounting firm Anders CPAs and Advisors.

If you have a question about stimulus checks, text 5 On Your Side at 314-444-5125. This is a text-only line. We’ll work to pass along your questions to the experts at Anders. We’ll share your questions and their answers during newscasts throughout the week.

Stimulus check resources:

- Here's why IRS' 'Get My Payment' may not work for you

- Find out when you'll get your stimulus check, or how to report if you don't get it

- ‘Not an insured worker’ but need to file for unemployment? Missouri has a new workaround

- If you didn't file your taxes in 2018 or 2019, here's what you need to do to get a stimulus check

- Millions of Americans will get stimulus checks, but here's who won't

Is there anything that an employee of a small business can do if they suspect that their employer received money through the small business relief fund but did not use it to pay their employees? We have been earning approximately one-third of our pre-COVID-19 pay and did not receive any extra pay from our employer.

The St. louis County small business relief fund was designed to reimburse businesses impacted by the pandemic. It could be used for multiple purposes, not necessarily payroll costs. It can even be used to reimburse for costs associated with preparing the business for social distancing requirements. Conversely, the Paycheck Protection Program created by the US Treasury also provides specific ways that the proceeds must be used. If the employer is seeking complete forgiveness of the loan amount then, 75% must be used for payroll costs. However, it is at the employer’s discretion how they use the loan proceeds, as long as they are used for the required purposes. If they choose not to use it for payroll purposes, it then becomes a loan the employer will be required to pay back.

How can you get your stimulus check cashed if you do not have an ID and are unable to get one?

Most banks require your ID be presented before they cash a check, but there’s no standard list for what’s considered an acceptable form of ID. Check with a local bank to see if you have a document that they’ll accept as ID.

If you have a bank account — but no ID — many banks allow you to deposit through an ATM or on their apps. If you have no bank account and no ID, talk with a local bank about signing your check over to someone else for deposit.

Can my adult son, who is homeless and doesn't have a checking account, deposit his stimulus check into my checking account? He has a different last name than mine. Will the bank clear the check or reject it? Or, should he just have the check sent to my address, and then sign check over to me so I can deposit it?

There are many options to cash your stimulus check, even if you do not have a bank account. If your son has a valid ID he can:

- Cash it at a retail store that cashes checks, such as Walmart or local grocery stores

- Take it to a check-cashing store.

- Cash it through services provided by PayPal or the Cash app

- Take it to a local bank. They may be willing to cash it without an account

If your son does not have a valid ID, check with a local bank to see if you have a document that they’ll accept as ID since there is no standard list. As a last resort, talk with your bank about signing the check over to you for deposit.

It’s important to note there may be fees with any of these methods.

I have a client who died and her family then received her stimulus check - the decedent has two children and her stimulus check includes $1,000 for her two kids - is her family able to cash this check or get a new check issued to the guardian of the children?

If the decedent died before the check was issued, the check should be returned to the IRS. Go on the IRS website’s Economic Impact Payment Information Center for further details on where to send the check.

If the guardian did not receive the full amount to which they believe they are entitled to, they will be able to claim the additional amount when they file their 2020 tax return. This include the individuals who may be entitled to the additional $500 per qualifying child payments.

If the payment was a paper check:

- Write "Void" in the endorsement section on the back of the check.

- Mail the voided Treasury check immediately to the appropriate IRS location listed below.

- Don't staple, bend or paper clip the check.

- Include a note stating the reason for returning the check.

If the payment was a paper check and you have cashed it, or if the payment was direct deposit:

- Submit a personal check, money order, etc., immediately to the appropriate IRS location listed below.

- Write on the check/money order made payable to “U.S. Treasury” and write 2020EIP and the taxpayer identification number (social security number or individual taxpayer identification number) of the recipient of the check.

- Include a brief explanation of the reason for returning the EIP.

Missouri mailing address is:

Kansas City Internal Revenue Service

333 W Pershing Rd.

Kansas City, MO 64108

All other states mailing addresses can be found on the IRS website.

The guardian can always call the IRS at 800-829-1040 between 7 a.m. and 7 p.m. for additional guidance.

If you're currently in a Chapter 13 and your tax debt is included in the payment plan, am I still entitled to a stimulus payment and/or would that slow the process down for receiving my stimulus payment?

No, if you are eligible, having filed Chapter 13 bankruptcy will not affect your stimulus check payment. The CARES Act excludes the stimulus checks from being considered as income for purposes of the Chapter 7 means test and for determining the amount to pay unsecured creditors in Chapter 13. This allows debtors in bankruptcy cases to keep stimulus payments and not have them used to pay creditors or deny bankruptcy relief. This provision applies to any case filed before or after enactment of the CARES Act., as of April 7, 2020.

If you took money out your IRA account. You have to add it to your yearly income. Does that affect you getting a stimulus check?

Yes. The stimulus check is based on your most recently filed return, 2018 or 2019. All of the information on this return is considered when it comes to evaluating your stimulus check. Since stimulus checks are a 2020 tax credit, the amount will be reconciled in tax year 2020 to ensure you receive the correct rebate amount. If you underpaid based on your 2020 income, you may receive an additional tax credit at this time.

Will my 22-year-old daughter receive a stimulus check if I did not claim her on 2019 but claimed her on 2018. She had filed her taxes before the CARES Act claiming herself, but I had not filed my taxes yet, but did on May 8. I received stimulus check back in April, but my daughter has not.

If your daughter is still a full-time student, she will not be eligible to receive a check. Those who can be claimed, including full time students up to the age of 24, are considered not eligible. This applies regardless if the taxpayer actually chooses to claim the dependent or not. If your daughter is not a full-time student, she should be expecting a stimulus check. She can check the status of her payment online using the Get My Payment tool on the IRS website or calling to discuss with an IRS representative (800-919-9835).

How do I see if I am receiving my ex’s stimulus check because he owes me child support?

The Missouri State Department of Social Services sent this helpful information:

The Department of Social Services, Family Support Division may intercept the Economic Impact (Stimulus) check if a non-custodial parent owes at least $500 past-due child support or has a Temporary Assistance for Needy Families (TANF) arrearage of $150 or more. The amount may be a combination of arranges from multiple cases involving the same individual. Please be aware that due to State and Federal laws intercept exceptions cannot be made.

It is important to note that intercept payments go on an automatic hold for at least 30 days so a person paying child support may request an administrative hearing. If a hearing is requested a payment will be held until an administrative decision is made. Missourians who have questions can call 1-866-313-9960 to speak to a Child Support team member.

Why have I received the letter but not my stimulus check? The IRS page says it was mailed out April 24?

If you're concerned the check was lost in the mail or the direct deposit was misdirected, the IRS says it will mail a letter to your address 15 days after a payment was issued. If you receive the letter but never received a payment (or the payment was in the wrong amount), the IRS lists a toll-free phone number to call: 800-919-9835. The IRS announced that it has added 3,500 phone representatives to answer callers’ common questions about stimulus payments.

I received a notice saying my stimulus was taken for back child support. I’m on SSI and have never had to pay child support. I called the agency they said I don't owe anything. What do I do?

Contact the Bureau of the Fiscal Service at 800-304-3107 (or TTY/TDD 866-297-0517), Monday through Friday 7:30 a.m. to 5 p.m. CST.

The CARES Act limits offsets of Economic Impact Payments to past-due child support. No other federal or state debts that normally offset your tax refunds will reduce the Economic Impact Payment. Nevertheless, tax refunds paid under the Internal Revenue Code, including the Economic Impact Payment, are not protected from garnishment by creditors once the proceeds are deposited into an individual’s bank account.

You can contact the agency with which you have a debt to determine if your debt was submitted for a tax refund offset. You may call the Bureau of the Fiscal Service 's TOP call center at the number below for an agency address and phone number. If your debt meets submission criteria for offset, Bureau of the Fiscal Service will reduce your refund as needed to pay off the debt you owe to the agency. Any portion of your remaining refund after offset is issued in a check or direct deposited as originally requested on the return.

The Bureau of the Fiscal Service will send you a notice if an offset occurs. The notice will reflect the original refund amount, your offset amount, the agency receiving the payment and the address and telephone number of the agency. Bureau of the Fiscal Service will notify the IRS of the amount taken from your refund once your refund date has passed. You should contact the agency shown on the notice if you believe you don't owe the debt or if you're disputing the amount taken from your refund. Contact the IRS only if your original refund amount shown on the Bureau of the Fiscal Service offset notice differs from the refund amount shown on your tax return. If you don't receive a notice, contact the Bureau of the Fiscal Service 's TOP call center at 800-304-3107 (or TTY/TDD 866-297-0517), Monday through Friday 7:30 a.m. to 5 p.m. CST.

I am a disabled grandmother raising my two grandchildren. I do not file federal or state taxes. What can I do to receive my $500 child credit money?

The IRS has already scheduled payments to taxpayers based on Social Security retirement, disability (SSDI) or survivor benefits and Railroad Retirement benefits. Supplemental Security Income (SSI) and Veterans Affairs (C&P) benefit payments will be scheduled shortly for payment in mid-May. The window has closed (May 5) to use the non-filer tool for these recipients who have a child and don’t normally file a tax return. These recipients who do not receive a payment that includes up to $500 for any qualifying children can file a tax return next year to determine their payment based on 2020 and claim any additional amount they weren’t paid this year.

If you do not fall into one of those categories mentioned above, you can use the Non-Filers Info tool located on the IRS website to receive your Stimulus check.

Is there a cutoff date for when a person has passed away that you can keep their stimulus check?

A payment made to someone who died before receipt of the payment should be returned to the IRS.

If the payment was a paper check:

- Write "Void" in the endorsement section on the back of the check.

- Mail the voided Treasury check immediately to the appropriate IRS location listed below.

- Don't staple, bend or paper clip the check.

- Include a note stating the reason for returning the check.

If the payment was a paper check and you have cashed it, or if the payment was direct deposit:

- Submit a personal check, money order, etc., immediately to the appropriate IRS location listed below.

- Write on the check/money order made payable to “U.S. Treasury” and write 2020EIP and the taxpayer identification number (social security number or individual taxpayer identification number) of the recipient of the check.

- Include a brief explanation of the reason for returning the EIP.

Missouri mailing address is:

Kansas City Internal Revenue Service

333 W Pershing Rd.

Kansas City, MO 64108

All other states mailing addresses can be found on the IRS website.

Will Social Security recipients who have a "representative payee" and don’t file taxes receive a stimulus check?

For Social Security and SSI beneficiaries who didn't file 2018 or 2019 tax returns, the IRS will use information the SSA provides to generate stimulus payments. In this case, representative payees will receive the stimulus payments on behalf of their beneficiaries in the same way they get monthly benefit payments — namely, by direct deposit, Direct Express debit card or paper check. The IRS says stimulus payments will start to be issued to beneficiaries with representative payees in late May.

My child, who turned 17 this year, has a disability and received a stimulus check. I think this was in error. What do I do?

Those with disabilities who get Supplemental Security Income are eligible under the law, unless they can be claimed as a dependent by someone else, a factor that disqualifies many. If the child was claimed as a dependent, then the check should be sent back to the IRS.

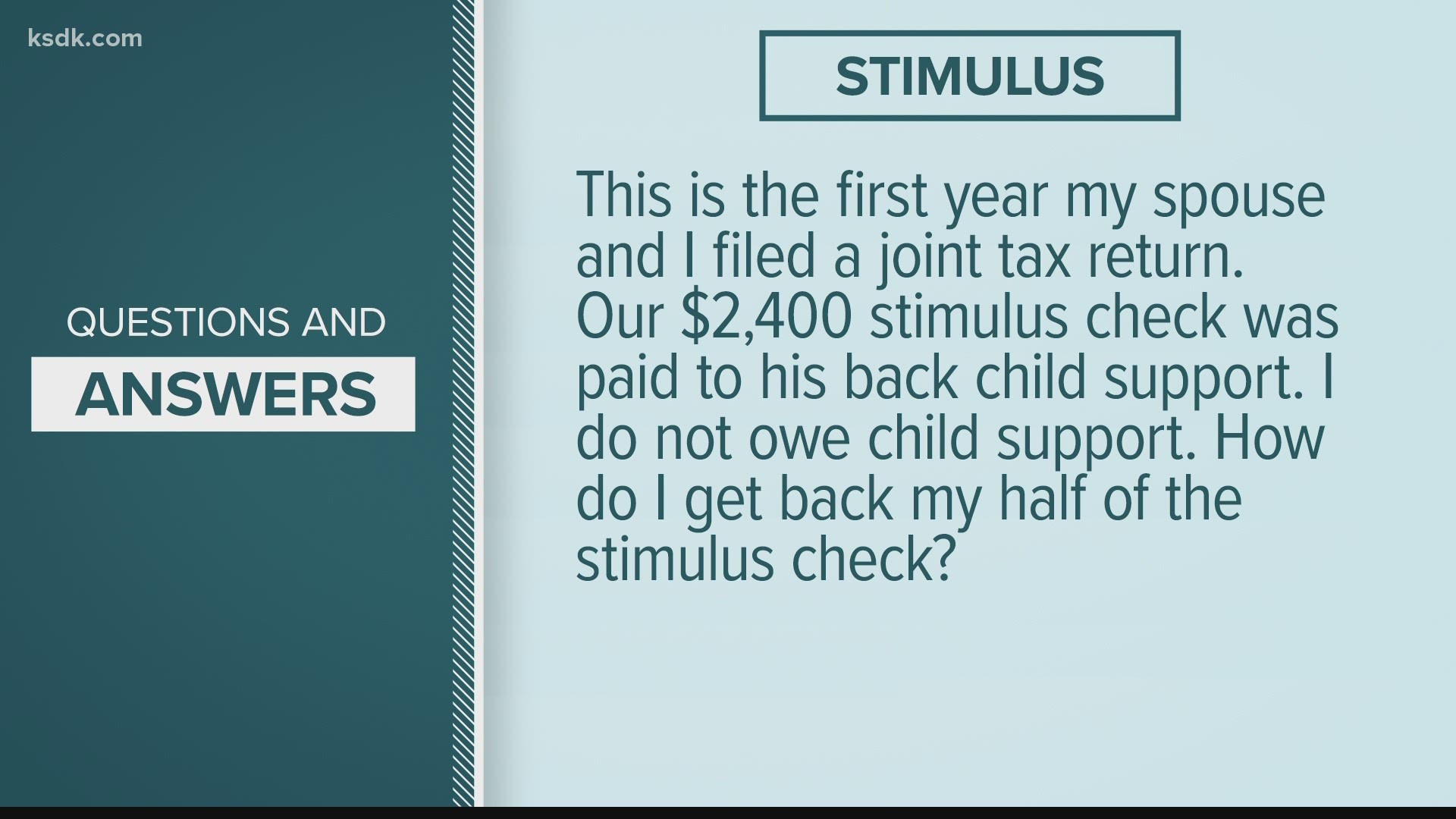

This is the first year my spouse and I filed a joint tax return. Our $2,400 stimulus check was paid to his back child support. I do not owe child support. How do I get back my half of the stimulus check?

This scenario technically isn’t an error. There are times when your stimulus check can and can’t be taken from you. The CARES Act specifically states that past-due child support is the only obligation that would subject stimulus payments to the Treasury Offset Program. This means individuals who are behind on child support will have their stimulus payment seized by the government to repay that debt.

This can create a mess for married couples who file their taxes jointly. When couples file jointly, one payment will be made to the couple, instead of each individual receiving a separate payment. If one spouse is behind on their child support payments from a previous relationship, the entire stimulus check will be taken as an offset — leaving the other spouse, who doesn’t owe child support, without their entitled money.

If you find yourself in this situation, there is a way to receive the money you’re owed. Individuals who lost their portion of stimulus payment due to a spouse that owed debt can file for injured spouse relief to get their portion of the stimulus check back. To file a claim, complete the Injured Spouse Allocation (Form 8379) and submit it to the IRS. You won’t need to wait until you file your next tax return to file the 8379, according to IRS instructions.

My stimulus check went to my old address and the person there lost it. What are my options?

If your address on file with the IRS is wrong, get ready for a challenging effort to recover your payment.

The IRS says it will mail a letter with information about how and where the stimulus payment was made, but this letter will go to the last address on file. This means that both your stimulus payment and the informational letter will be heading to a place where you no longer live. Not helpful.

One option to try and recover your check is to log on to the USPS website and have your mail forwarded to you from the old address you think might be on file with the IRS, if you haven’t done so already. As of now, there isn’t official insight on how lost stimulus payments can be recovered. When you file your 2020 tax return, you can make a case with the IRS for why you didn’t receive your payment and may be able to claim it then. But that’s just an assumption for now. We will all have to wait until there’s more guidance from the IRS to say for sure what the remedy will be.

Are stimulus payments delaying tax refunds? I filed electronically on March 17 and requested my refund by mail. I haven't received it yet.

There is no indication stimulus payments are delaying tax refunds. However, all processing with the IRS is delayed right now. Keep checking the IRS website for the status of your return and your stimulus payment. Stimulus checks being mailed will take longer to get to taxpayers than those coming via direct deposit.

I got the check, but it has my name and the name of my former husband on it. Can I get it reissued in my name only?

It is not likely you can or will get a reissued check. Assuming there is a cordial relationship, we recommend reaching out to your ex since half of the payment should go to your former spouse. Additionally, if the check is made out to both, it is likely the check will need to be endorsed by each before depositing. If the check is able to be deposited and the entire amount is kept by you, the IRS could adjust your 2020 tax return to make your ex whole on their 2020 tax return.

My 17-year-old daughter filed 2019 taxes and received a stimulus check. I haven't filed 2019 yet, but I have always claimed her as dependent and plan to this year. She shouldn't have gotten the check! How will this impact my 2019 tax return or possibly even my ability to claim her?

It doesn’t sound as if your daughter should have received a stimulus check. However, as of today, the IRS does not require payments made in error to be returned (unless to a deceased individual). This payment should not impact your 2019 tax return, your ability to claim her or your stimulus check.

My husband and I withdrew money from my retirement account last year, which put us over the income limit to receive a check. Since this was a onetime withdrawal and not actual income, is there a way for us to get the check?

Since the stimulus check is based on your most recently filed return (2018 or 2019), the information for that tax year is considered. Unfortunately, if you withdrew funds from your retirement account that year and are over the income limit, you will not be receiving the stimulus check right now. However, since this is actually a 2020 tax credit, the amount will be reconciled in tax year 2020 to ensure you received the correct rebate amount. If you are underpaid based on your 2020 income, you may receive an additional tax credit at that time.

I have heard conflicting reports. Are the stimulus checks actually from our 2020 tax refunds? If so, if you owe money at tax time do you have to repay it?

The way the law is written, the stimulus checks are actually just advanced payments of a new "recovery rebate" tax credit for the 2020 tax year. According to the IRS, you won't be required to repay any stimulus check payment when filing your 2020 tax return — even if your stimulus check is greater than your 2020 tax refund.

This was the first year I have to file tax returns being only 25 and graduating law school last year. I have filed and received my tax return. I have not gotten my stimulus check and when I look it up on the website, it says it still can’t determine my information. I put in my SSN, birthdate, address and ZIP code, but it still doesn't find me. What else can I do to check it?

Because this was your first year filing, there is no 2018 information on file. The IRS is still processing 2019 tax returns. Continue to check the IRS website for updates. Based on the information you provided, it appears you are eligible, but it will not be as fast as those who filed a 2018 tax return.

My wife passed in January 2020. I returned the $2,400 uncashed stimulus check to the IRS per instructions on the website. When can I expect to receive a new check for my $1,200?

It appears you should have only returned $1,200 rather than the full $2,400. Unfortunately, the IRS has not indicated at this time when replacement checks will be issued, if at all. If no replacement check is received, you would be able to claim the $1,200 credit on your 2020 tax return.

My son, age 20, has not received his check but is eligible---filed and received a refund on his 2018 and 2019 taxes, is still using the same bank account, is not claimed as a dependent and made (way) less than the $75,000 limit. When we use the portal, it just says "Payment Status Not Available". Any suggestions on what we can do?

Based on the information you provided, it appears that he is eligible and should be receiving a direct deposit, although many payments are still yet to be issued. I would continue to periodically input the information on the IRS website for updates. You didn’t indicate whether he is a college student or not. The IRS ruling is such that full-time students ages 19 to 24 can be claimed as a dependent on another return. If your son meets that standard, then he wouldn’t be eligible, regardless of whether you claimed him or not.

Does someone who has died qualify for the payment?

No. A payment made to someone who died before receipt of the payment should be returned to the IRS by following the instructions about repayments. Return the entire Payment unless the Payment was made to joint filers and one spouse had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent. This amount will be $1,200 unless adjusted gross income exceeded $150,000.

What if my mom claimed me as a dependent in 2018 but not in 2019 and I had my federal tax refund with direct deposit? Will I qualify for the stimulus money?

Yes. The real question is how long it will take the IRS to process your 2019 return and your mom’s 2019 return. In your situation, processing those returns is necessary to determine your eligibility for the stimulus money.

Last year my husband and I filed a joint income tax return. The refund check that we received from the IRS was deposited into his checking account. Since that time, he has passed away, and that account has been closed. In addition, I now reside at a different address. My question is this: who do I contact with my new information?

If you want the IRS to send your check to a different bank account or address, the best option is to submit a 2019 tax return (if you haven't yet) with your current details. And this will work only if the IRS hasn't already processed your payment or sent it out. Also make sure the USPS has forwarding information for you. We expect the IRS should address and correct any delayed/missing payments by 12/31/2020. If the check is not received by then, the discrepancy can be addressed on the 2020 return.

My 41-year-old son had been in prison for DWI for five years and just got off probation of three years but cannot hold a job because of PTSD and medical problems. Is he entitled to stimulus payment?

If, we are reading this question correctly, your son has been on probation for the past three years. Under that scenario, if he filed any returns in 2018 or 2019, he is eligible for the stimulus payment. If he did not make enough money to file, he will need to go online to the IRS' non-filers payment site.

However, if he is incarcerated, he does not qualify for a stimulus check. In fact, if a person in jail or prison gets a payment, they're supposed to return it to the IRS immediately. The entire payment should be returned, unless it was made payable to joint filers and only one spouse is incarcerated. In that case, only the portion of the payment for the prisoner needs to be returned.

My stimulus payment got sent to the wrong address due to my tax lady putting the wrong house number on my tax return and the lady sent it back to the post office. Three times they sent it to her. For the fourth time, she shredded my check. How can I get a check reissued to my new address?

The IRS has indicated it will be sending out follow-up letters within 15 days of distributing stimulus payments. These will provide instructions on what to do if there is a problem. If this letter is successfully delivered to you but your payment wasn't, follow the instructions on it to let the IRS know, so they can get you the money you're entitled to receive. Again, we expect the IRS should address and correct any delayed/missing payments by 12/31/2020, and if the check is not received by then, the discrepancy can be addressed on the 2020 return.

I haven't received my stimulus check and don't have a date to when it'll be issued what should I do?

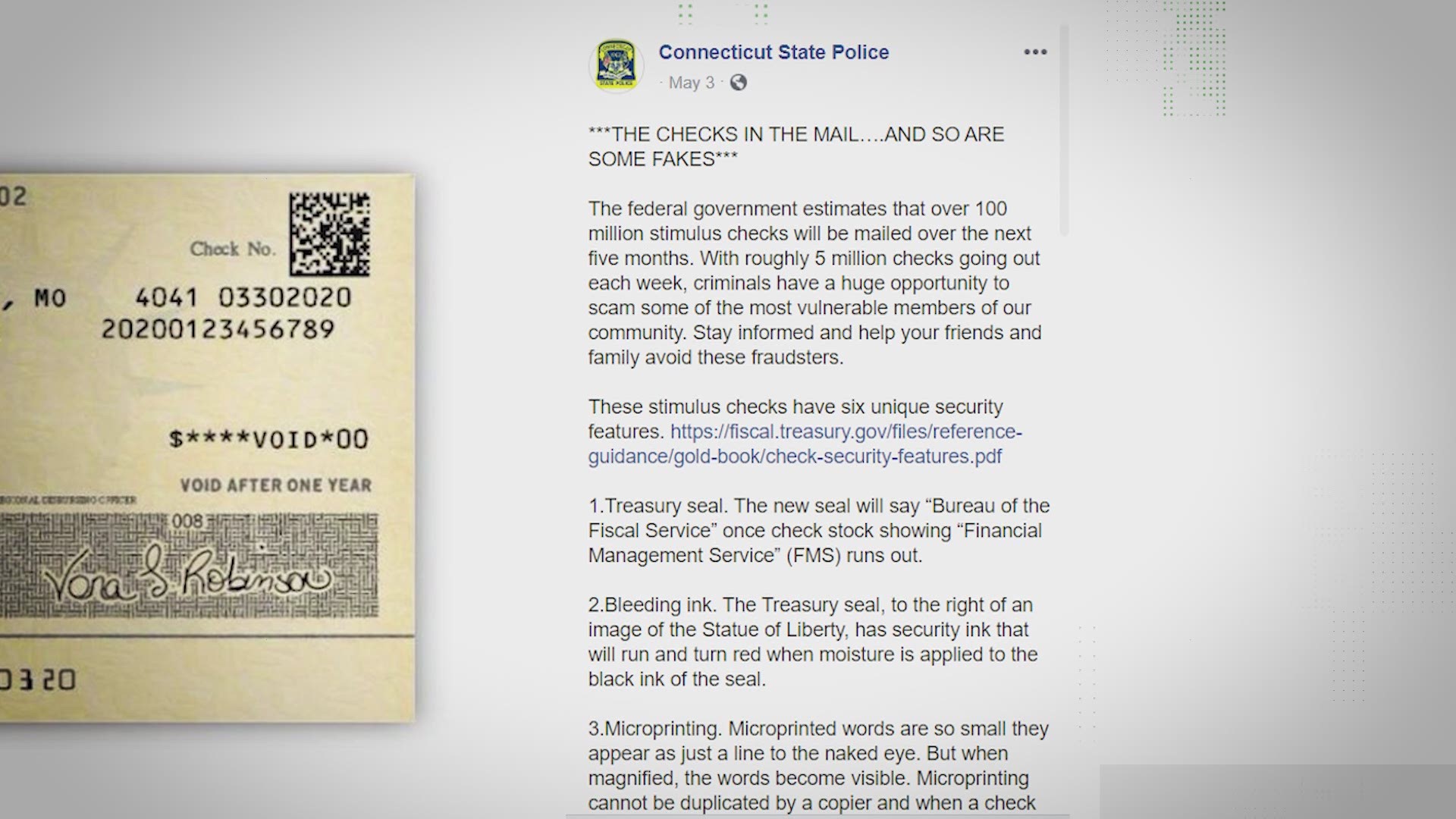

Keep checking the Get My Payment tool. The IRS says it’s updating its website daily. The IRS also began sending paper stimulus checks according to a schedule. They are mailing approximately 5 million paper checks per week, starting with the lowest adjusted gross income first.

If an employee voluntarily left your employment mid-March for another job with better benefits, do you need to replace that employee to qualify for forgiveness of your PPP loan?

If that employee was counted in the period that you used to set your baseline, you would need to replace that FTE (Full Time Equivalent) position. If you fail to replace that position, your forgiveness may be reduced.

I currently receive survivor benefits, Social Security and Veterans Affairs money. I filed under the non-filers tool on the IRS website. Before the first deadline, I added my daughter who is a minor as a dependent. Shortly after, I checked my stimulus check status and it was pending. I received it but it was only for $1,200. The extra $500 for each dependent was not included. Will I receive the second payment separately and additionally?

The most recent guidance from the IRS issued on May 1, states that those who miss dependent payments now will have to wait until they file a 2020 tax return to receive that money. Those who have not registered under the non-filers tool on the IRS website have until today (May 5th) to register and enter their dependents information to receive the full amount. There is a chance that a check could come separately, but not guaranteed. Once the stimulus checks are distributed, we are hearing that the IRS will begin addressing these types of situations.

If my mom filed taxes and claims me, and I also get a direct deposit refund, am I eligible for a stimulus check if she didn't receive $500 for me?

In short, the answer is no. However, whether parents get an additional $500 depends on your age. Anyone over the age of 16 years old and claimed by someone else as a dependent will not receive a stimulus payment. The person claiming that individual will also not get the extra $500 because those extra payments are only for dependents under 17 years old. Children who are (or can be) claimed as dependents by their parents are not eligible individuals, even if they have enough income to have to file a return.

I have tried several times on the IRS website to find out about my stimulus check for me and my wife. It keeps telling me the information is incorrect. All information is correct. What can be done or what steps should I take? I still have not received a stimulus check.

Unfortunately, the IRS is not accepting phone calls right now. As many taxpayers report difficulty accessing the site, the last statement the IRS issued stated that the Get My Payment site "is operating smoothly and effectively." However, from what we are reading, taxpayers are experiencing issues because so many people are trying to use the system at one time and the website is getting overwhelmed. We would recommend to keep checking the status on the IRS website regarding your stimulus payment. Payments for those receiving a check instead of direct deposit are being sent to taxpayers with the lowest adjusted gross income first, so it could take some time until all checks are mailed. The last date for the government to issue stimulus checks is 12/31/2020. We would expect this to be resolved well in advance of this date, but there can always be discrepancies that will be addressed on their 2020 return.

Is the extra $600/week on unemployment taxable income?

Yes it is. You will receive a 1099-G next January showing the amount to be reported as income on your 2020 tax return.

I am a small business owner and have already laid off my employees, can I qualify for the Paycheck Protection Loan if I bring my employees back?

Absolutely. You can actually qualify for the loan even if you are not able to bring all of your employees back; although, your loan forgiveness might be decreased. The more employees you bring back, then your potential for maximum loan forgiveness is greater.

Can my stimulus payment be intercepted if I owe child support?

Yes, the CARES Act allows the Treasury Offset Program (TOP) to collect delinquent child support obligations. The TOP can take your entire stimulus check, up to the amount you owe.

My stimulus check was deposited to an old bank account, deposited in an incorrect bank account or mailed to my old address. What do I do?

If the account is no longer active, the bank will reject the deposit and the IRS will issue a check. You can visit irs.gov to find the status of your stimulus check and/or update your address. If your check has not yet been issued, you can file a change of address (Form 8822) with the IRS. In any scenario, if you do not receive your money now, it will be reconciled when you file your 2020 tax return.

My wife and I have separate checking accounts. How do we get the check?

If you had a refund directly deposited for tax year 2018 or 2019, the IRS will deposit the payment into the bank account used on the tax return. If you elected to split your refund between several accounts, you cannot use the Get My Payment tool on the IRS website to designate which account to have your payment deposited in. The IRS will deposit the payment to the first bank account listed on Form 8888, Allocation of Refund. If your direct deposit is rejected, your payment will be mailed to the address on file with the IRS.

We claimed our 19-year-old son as a dependent in 2018. He is in college now, and we have student loans. Our household of five earns less than $75,000 a year. Am I better off claiming him as a dependent and not receiving the $1,200 from the stimulus check, or should I file separate 2019 taxes for him so he would receive the $1,200?

The IRS website lists an individual who can be claimed as a dependent on someone else’s tax return as being ineligible for the Economic Impact Payment. If you provide more than half of your son’s financial support, then he is a dependent. If he has a filing requirement, he must check the box on the tax return to indicate that someone else can claim him as a dependent.

My husband receives U.S. Railroad Retirement Board benefits. We file taxes every year, but if we have a refund, it comes in the mail. Since our return doesn't go to direct deposit, will I receive mine with his? If not, what do I need to do?

If you filed your 2019 or 2018 tax return but did not receive a refund by direct deposit, your payment will be mailed to the address the IRS has on file even if you also receive Railroad Retirement benefits by direct deposit.

You have the opportunity to provide bank account information through the IRS Get My Payment tool before your payment is processed. Direct deposit is the fastest way to receive your payment.

Is the stimulus check just an advance on our 2020 tax refunds? If so, can we opt out?

The stimulus checks are independent of any other tax refunds and are not a pre-payment of a refund. Once they are issued, they do not have to be repaid, nor do they reduce your 2020 tax refund.

My husband and I owe taxes. Are we eligible for the stimulus check?

You can still receive a stimulus check if you have outstanding tax liabilities. As long as your income level qualifies, and you meet the other criteria of having an address, banking info on file with the IRS, etc., you will receive a stimulus check.

My former husband owes back child support. Since he’s delinquent, will he receive a stimulus check? If not, what happens to the $1,200?

In the CARES Act, Congress specified that past-due child support is the only obligation that would subject stimulus payments to the Treasury Offset Program (TOP). The TOP will still be legally allowed to seize your stimulus payment if you’re behind on child support and your state has referred those payments to TOP for collection.

For divorced couples with children who alternate filing with their children as dependents, who will get the stimulus check?

The checks are based on the dependents claimed on the tax return the IRS uses to calculate the stimulus amount. As such, whoever claimed the children in that year will receive the $500 payment for that child.

Will people with disabilities who receive SSI/SSDI and don't file taxes receive a stimulus check?

Yes, they will. The IRS has their mailing and bank information on file from the Social Security Administration, and no further action is required to receive the stimulus check. If you receive SSI/SSDI and have dependents, you will have to go online to the IRS website to provide your dependent’s information so that you will receive the maximum stimulus payment for your family.

My husband passed away in December, and we jointly filed 2018 and 2019 taxes. I got a $2,400 stimulus check. Do I have to repay $1,200 of it?

As it stands today, the IRS is only looking at the filing status and Adjusted Gross Income of taxpayers for calendar 2019 (or 2018 if necessary). The IRS is not requiring any repayment once stimulus money is received based on the tax return relied on to determine the amount. As such, if you receive $2,400 based on the tax return the IRS reviewed, you will not be required to repay any of it.

If I have a payment plan with the IRS and payments are being debited from my bank account, do I need to do anything further to get my stimulus check?

No, nothing further is needed as the IRS payment plan and the IRS stimulus checks are not interrelated. The CARES Act actually suspends almost all efforts to garnish tax refunds to repay debts, including those to the IRS. If you contact the IRS, they are offering to suspend installment plan payments from April 1 – July 15. If you would like to take this option, we would recommend contacting your bank to stop the automatic draft of payments to any payment plan.

Can people experiencing homelessness qualify for a stimulus check if they don't have a mailing address?

While anyone can qualify for the stimulus check, the individual must fall under certain income limitations, have a valid Social Security Number and cannot be claimed as a dependent by someone else. However, individuals will need to have their bank account information and mailing address on file with the IRS to receive payment, which can be updated online. Those who are not sure if they have this information on file with the IRS or have not filed an income tax in the past two years can update their information with the IRS at irs.gov/coronavirus/economic-impact-payments.

As such, if a person experiencing homelessness does not have a current address and does not have access to one by way of a friend or family member, we would recommend they contact their nearest homeless support organization to see if they can help. The same advice applies if they do not have access to a bank account.

Can college students who have jobs and filed taxes for 2019 receive a stimulus check?

If children, including some college students, can be claimed as a dependent on someone else’s return, they are not eligible for the stimulus check. Given this, any college student claimed as a dependent would not receive a check. However, if you are not claimed as a dependent (whether you are a college student or not), you could qualify if you meet the other criteria. This has been a common question among our clients, and you can find this and additional answers like these at our COVID-19 Resource Center at our website anderscpa.com.

If I had my taxes prepared by a company that issues a refund to a debit card, will my stimulus check be deposited to it or to my checking account?

While it appears the IRS contemplated issuing stimulus payments via debit card, it was decided the stimulus checks will only be directly deposited into bank accounts on file with the IRS or mailed to taxpayers at their last address of record if they do not have a bank account on file with the IRS. As such, if your last bank account of record with the IRS is the account used by your tax preparer’s bank for your debit card refund, our advice is to update your bank account information on file with the IRS to have your stimulus check directed to a different account. This can be done on the IRS Economic Impact Payments website.