ST. LOUIS — Elizabeth Gentile mailed a check for $200 to pay one of her mother’s bills.

It was a seemingly mundane, everyday move that ended up costing her a lot more, and questioning what the postal service and banking industry are doing to keep consumers like her safe from scammers.

One month after the check went into a blue mail box near Tower Grove Park in St. Louis, someone cashed it for more than $7,000.

As soon as Gentile went to her bank, she learned she was one of countless people across the country, including the St. Louis region, who are victims of mail theft.

It’s a crime that’s been surging all year. The I-Team reported in April the postal service’s failure to keep track of arrow keys that mail carriers use to open blue boxes is largely to blame.

Thieves then steal checks they find, wash the ink off them and sell them on the dark web. They are then cashed for hundreds, if not thousands of dollars.

Gentile said the banking industry is playing a role in the crisis, too.

“You almost want to just blow a gasket,” she said. “If a bank is aware that this is going on, wouldn't your employees be double checking?”

U.S. Bank spokesman Evan Lapiska declined to comment on Gentile's case, but wrote, "We are pleased to have it resolved."

"At U.S. Bank, we take fraud seriously and our teams work around the clock to prevent fraud or when it occurs mitigate the impact for our customers. If customers spot something suspicious, they are encouraged to report it immediately to our U.S. Bank Fraud Liaison team which is available 24 hours a day, seven days a week," he wrote.

Matthew Villicana, a St. Louis-based postal inspector and spokesman for the Chicago Division, refused to be interviewed for this story, “In order to not compromise our current preventive and investigative efforts.”

The I-Team has discovered there has been some progress that’s been made on the legislative front -- but it's a step the postal inspectors oppose.

Some in the banking industry also are beefing up security efforts to try to stop checks like Gentile's from getting cashed.

And there are steps people can take to protect their checks.

Checks sold on the dark web

Gentile of St. Louis Hills said she mailed the check to pay her mother’s EMS bill in June.

“I kept on checking my statements to make sure that the check had been cashed, and I noticed it wasn't cashed, it wasn't cashed,” she said.

About a month later, she checked again.

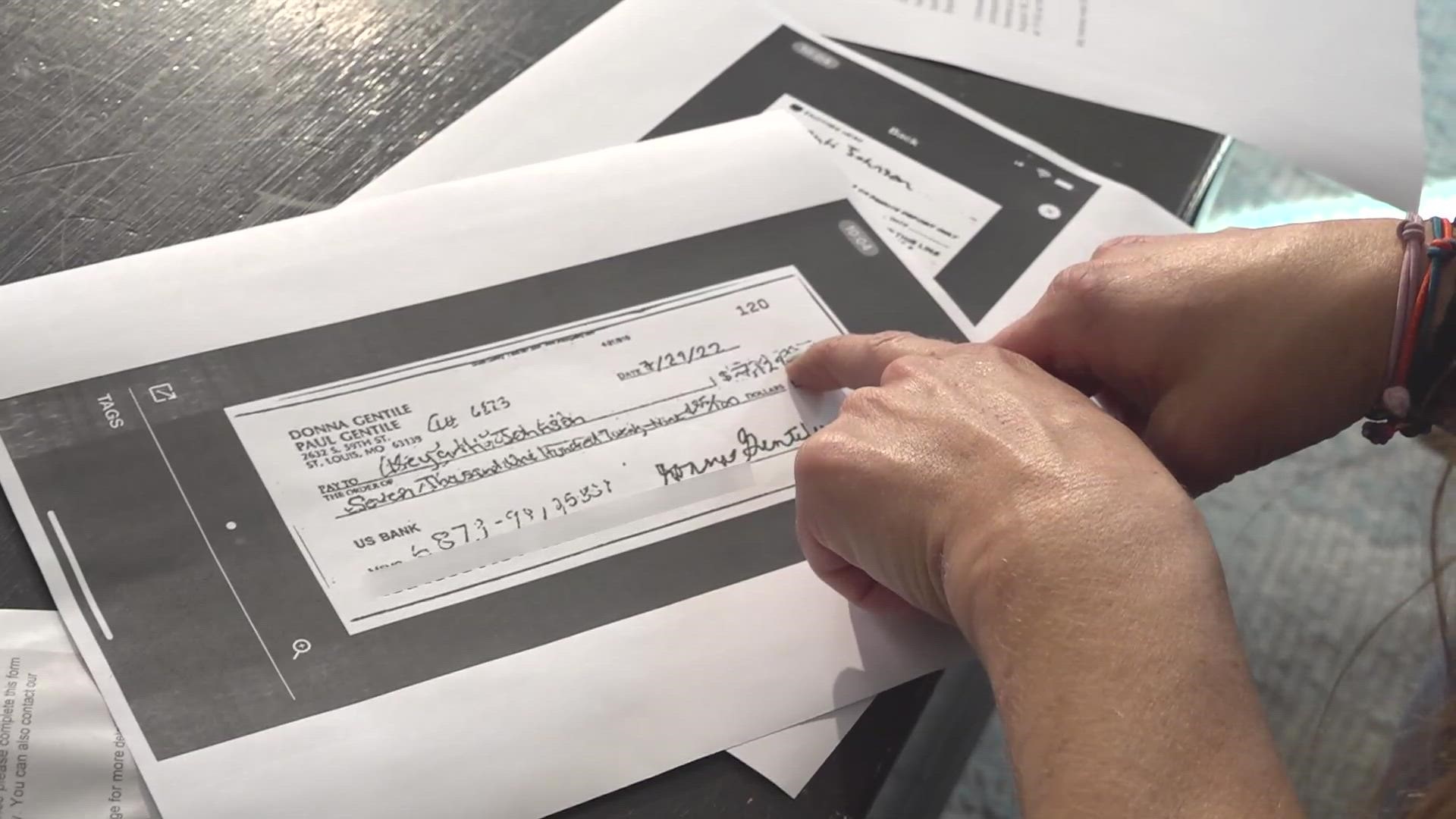

“It was cashed for $7,135 at a U.S. Bank without the correct information on it,” she said. “It appears to be washed.

“I just went straight to the bank like, what the heck just happened to me? “

Earlier this year, 5 On Your Side interviewed Associate Professor David Maimon of Georgia State University, who has been tracking the issue.

Thieves use household chemicals to wash off the ink from a check and often make it payable to themselves or someone else involved in the scheme.

Gentile’s check was made out to Kayanti Johnson.

“I have no idea who that is,” Gentile said.

The copy of the check Gentile got after it had been cashed shows much of her original handwriting can still be seen faded behind the new handwriting.

Maimon said check washing can be much worse than just stealing money for victims.

"Once they have the checks, they have the identity of the victim and they can continue using the identity for printing fake driver's licenses, passports and they have the bank account details,” Maimon said.

He said his team of researchers have found dozens of videos and pictures of gang members using stolen arrow keys.

Gentile has a suggestion.

“Just take out the blue boxes,” she said. “Honestly, just take out the blue boxes.”

Multiple warnings about failures

The I-Team also reported earlier this year that an audit in 2020 faulted the postal service for gaps in arrow key accountability.

The matter made it all the way to a Congressional Subcommittee on Government Operations meeting in September, led by Rep. Gerry Connolly, D-VA 11th District.

Legislators listened as postal police officer’s union leaders talked about how mail carriers are being robbed at gunpoint all over the country for their arrow keys.

“Certainly, in response, the postmaster general in the USPS has beefed up the police service,” Connolly said.

“No, they did the exact opposite,” said Frank Albergo, president of the Postal Police Officer’s Union. “They started defunding us, they revoked our jurisdictional authority, and they confined us to postal property.”

“That not only makes no sense, but it frankly puts both postal workers and the public at risk and that's unacceptable to this subcommittee,” Connolly said.

Congresswoman Eleanor Holmes Norton, D-DC has since filed a bill that would put postal police officers back on patrol, protecting mail carriers and targeting hot spots where mail theft is prevalent.

But the force has been decimated, Albergo said.

“The inspection service has eliminated entire postal police tours in Detroit, Memphis, Oakland, San Francisco, St. Louis, Washington D.C. and even here in Philadelphia,” Albergo told the subcommittee.

Albergo said the postal police force of about 2,700 officers nationwide decades ago is now down to about 350.

Albergo described postal inspectors as the detectives on a police force, and postal police officers as street officers.

To be effective at stopping arrow key thefts and mailbox break-ins, you need both, Albergo said.

“They seem more interested in investigating crime than preventing it,” Albergo said.

A district manager for the U.S. Postal Service, Gary Vaccarella, also attended the hearing and explained the decision to limit the duties of postal police officers.

“The inspection service is also working to improve collection box security with key and lock enhancements,” he said. “We are aware of legislative proposals to expand the jurisdiction of postal police officers or PPOs, however PPOs are assigned to certain facilities because the inspection service has determined that these facilities require the presence of uniformed trained and armed officers."

“Removing those officers from postal service property would increase the security risks to those facilities. The inspection service determined that allowing PPOs to patrol the streets would not decrease mail theft or improve letter carrier safety. It is the role of the postal inspectors to investigate these crimes," he also said. "PPOs will serve as a vital role in the security of the nation's mail system and that function should not be compromised through modification of authority that would detract from the protection of the greatest number of postal employees, customers and property.”

Albergo argues, the inspectors can’t keep up with the amount of mail theft.

So far this year, 16 people have been indicted on mail theft charges in the St. Louis region, according to the U.S. Attorney’s Office.

Mail theft is a federal crime, but it’s a nonviolent crime, so sentences are typically not as harsh.

Police departments throughout St. Louis County – including Clayton and Brentwood -- have reported dozens of victims have had checks stolen.

The Postal Inspector’s Office asked a police chief not to talk about the issue with 5 On Your Side moments before a scheduled interview.

No one from the Postal Inspector’s Office contacted Gentile about her case.

She reported it to St. Louis police and hasn’t heard whether the person who cashed her check was ever charged.

What are banks doing?

It took three months for Gentile to get her money back.

She is a single mother and lives in an apartment in St. Louis Hills.

“I've got to feed my child, life goes on, and here I am waiting for this money,” she said.

She had to borrow money from friends and family during that time just to stay afloat.

“How does somebody without a driver's license walk into a bank and withdraw $7,000 from somebody else's account?” Gentile said.

The mail theft and check washing problem has pushed other financial institutions, like the First National Bank of Waterloo, to beef up training sessions for tellers on how to spot and stop fraudulent checks.

“It's definitely been on the increase in the last few years,” Jenny Lanzafame, vice-president of operations for the bank, said.

The I-Team asked Lanzafame to look at Gentile’s check.

“I would say it’s suspicious just from looking at it, mainly all that background ink that you see,” Lanzafame said.

She said she was and wasn’t shocked that the check got cashed at another bank.

“Unfortunately, I think it's something that happens more often than we even realize,” she said.

Lanzafame said the public isn’t totally powerless.

“The best thing you can do is honestly look at your account, look at your activity, not just look at your balance,” she said. “And one of the first calls you make is to us when you see there's a problem.”

Gentile said she is concerned about how many people are about to mail checks during the holiday season.

“How long are we going to allow this to happen to people?" Gentile said. "I mean, $7,000, I could have lost a lot more in general from just trying to survive without that.”

How to protect yourself from mail theft

What the postal service recommends:

- Report stolen mail by calling 1-877-876-2455 or www.uspis.gov.

- Promptly pick up your mail, don’t leave letters and packages in your mailbox or at your door for any length of time.

- Deposit mail close to pick-up time before the last collection or inside your local Post Office.

- Inquire about overdue mail. If you don’t receive a check, credit card or other valuable mail you’re expecting, contact the sender as soon as possible and inquire about it.

- Don’t send cash.

- Arrange for prompt pickup. If you cannot be home to receive a package, make another arrangement or use the USPS Hold Mail Service.

- Use Hold for Pickup. When shipping packages, use the Hold for Pickup option, and the recipients can collect the package at their local Post Office.

What bankers recommend:

- Check banking statements regularly to see if checks are cashed for the amount you wrote

- If you find a problem, call the bank as soon as possible to report it

- If you write checks, call those individuals or make sure that process is timely, and it's not been months or longer than you think it should have taken to get there and be processed

- Opt for online banking as much as possible

What the postal service recommends:

- Report stolen mail by calling 1-877-876-2455 or www.uspis.gov.

- Promptly pick up your mail, don’t leave letters and packages in your mailbox or at your door for any length of time.

- Deposit mail close to pick-up time before the last collection or inside your local Post Office.

- Inquire about overdue mail. If you don’t receive a check, credit card or other valuable mail you’re expecting, contact the sender as soon as possible and inquire about it.

- Don’t send cash.

- Arrange for prompt pickup. If you cannot be home to receive a package, make another arrangement or use the USPS Hold Mail Service.

- Use Hold for Pickup. When shipping packages, use the Hold for Pickup option, and the recipients can collect the package at their local Post Office.

What bankers recommend:

- Check banking statements regularly to see if checks are cashed for the amount you wrote

- If you find a problem, call the bank as soon as possible to report it

- If you write checks, call those individuals or make sure that process is timely, and it's not been months or longer than you think it should have taken to get there and be processed

- Opt for online banking as much as possible

If there's something newsworthy happening where you live send us an email to tips@ksdk.com and our team of reporters will look into it.