ST. LOUIS — St. Louis bankers are hearing from customers who are nervous about their ability to live up to the terms of business loans as a result of the coronavirus pandemic.

The good news: Banks are offering lower rates, extending terms and reaching out to businesses to let them know they will work with them.

What's more, bank regulators are supporting all of these efforts.

"We are hearing from clients who are looking for temporary credit availability to assist them with potential cash flow," said Jim Regna, president and CEO of St. Louis-based Triad Bank, with $331 million in total loans as of Dec. 31. "The bank is prepared to forgo principal payments and extend new credit if requested."

"We have had a few inquiries from some of our small business customers, and they have expressed concerns about their ability to make future loan payments," said Gary Hemmer, president of First National Bank of Waterloo in Illinois, with $130 million in total loans.

Hemmer said his bank also has had inquiries from borrowers about lower rates as a result of the drop in the prime rate from 4.75% to 3.25%. "On the retail side, we have had a big response on refinancing mortgage loans as we have experienced a drop in mortgage rates."

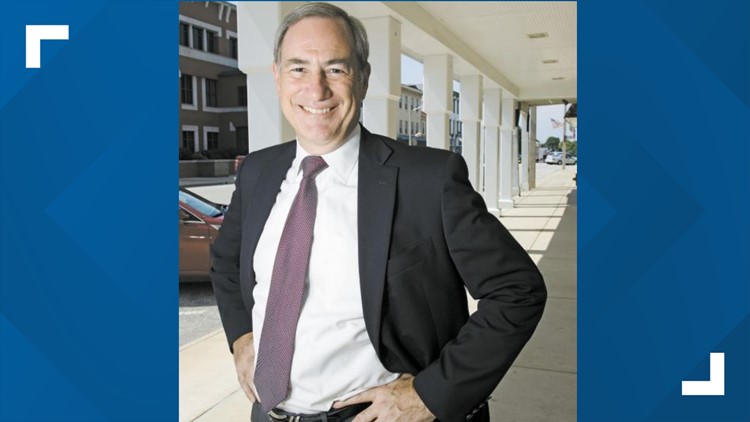

Scott Goodman, president of Enterprise Bank & Trust, with nearly $9 billion in total loans in St. Louis, Kansas City, Phoenix and New Mexico, said: "We have been proactively reaching out to a large portion of our business and commercial clients over the past week to ask (1) how they expect their businesses to be impacted, (2) how we, as their bank and financial adviser, can help, and (3) their thoughts and ideas we are hearing from other businesses across all of our markets."

Click here for the full story.

More Local News

- Employee in huge downtown St. Louis tower tests positive for coronavirus

- Plastics facility closing, 105 to be laid off

- 'We all lean on each other' | Pappy's Smokehouse owner says St. Louis restaurants are in survival mode

- 'I think she's going to be a good distraction' | St. Louisans help clear animal shelters amid COVID-19 concerns

- 'It can happen to anybody' | 5 members of one St. Louis County family diagnosed with COVID-19