ST CHARLES, Mo. — You work hard for your money, and when you put it in the bank you expect it to stay there.

But what if your bank shut down your account with little to no warning?

That's what a technology firm in historic downtown St. Charles says recently happened to them.

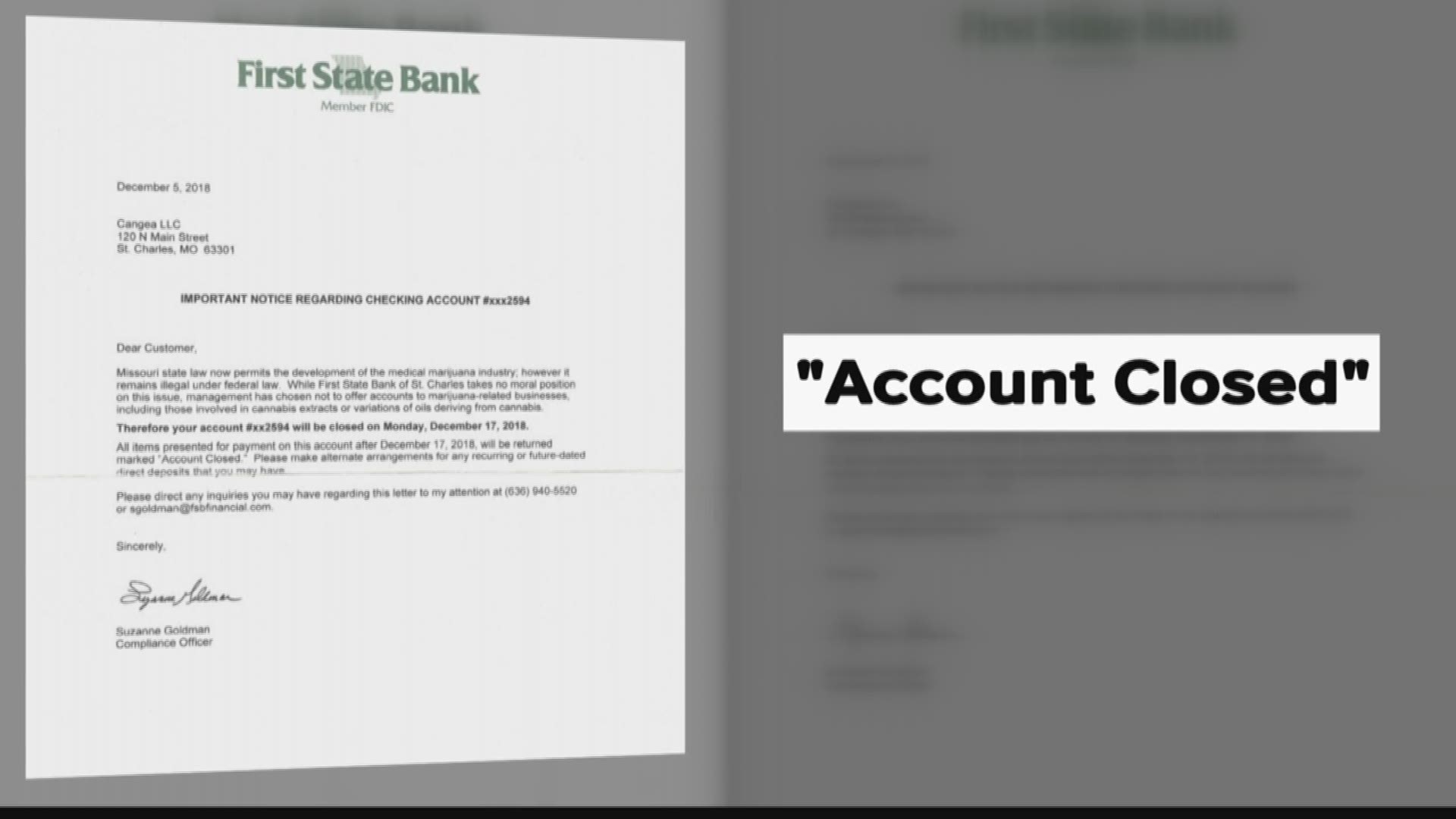

Jay Lindberg, the founder of Cangea, says he got a letter from First State Bank informing him his checking account was being closed.

The company's ties to the marijuana industry are to blame.

"We're a technology company. We don't touch the plant. We were still denied a bank account," he told 5 On Your Side.

The move left with some pressing questions he had to scramble to find answers for immediately.

"How do you pay employees? How do you pay rent? How do you pay vendors," Lindberg said

Turns out, Cangea isn't the only pot-related business facing this financial dilemma.

With Missouri voters passing medical marijuana in November, there are now 33 states with some form of legal cannabis.

But according to the American Action Forum, a non-profit issue advocacy group, only 30% of marijuana businesses have bank accounts and fewer than 500 banks or credit unions have accounts for such businesses.

And it's happening at a time when when the AAF estimates the legal pot industry in the U.S. will soar to $146.5 billion by 2025.

"This is a billion dollar problem," Lindberg said.

So what's driving the issue?

Simply put, cannabis-related businesses are caught between major discrepancies in state and federal laws.

Missouri, for example, now says medical marijuana is legal. However, the federal government still doesn't see it that way. Under the Controlled Substances Act, the cultivation, distribution and possession of marijuana is considered a crime.

That has created a conundrum for banks and credit unions. They're also regulated by the federal government and must adhere to federal financial laws.

Even handling proceeds that might stem from marijuana-related transactions could be considered money laundering, according to the U.S. Treasury.

"It's a high risk activity to a financial institution because it's not legal under federal law," said Luanne Cundiff, the President & CEO of First State Bank.

Cundiff told 5 On Your Side since November, her bank has had to turn away "some" businesses in the pot industry seeking an account.

She said she's aware of the challenges that can create for entrepreneurs and start-ups with bills to pay.

"I absolutely understand, and that's what we're asking. It's a huge problem. But until we receive guidance, it's going to continue to develop," Cundiff said.

She said the banking community is anxiously awaiting some guidance from the federal government.

"We just want to make sure we have clarity in terms of who we can bank with and who we can't," she said.

Last week, a U.S. House subcommittee held hearings on the issue and the SAFE Banking Act of 2019. It's legislation aimed at lifting some of the barriers and making it easier for banks to do business with those in the marijuana industry.

Its future in Congress remains uncertain, as prior versions have floundered.

Meanwhile, Lindberg said many pot-related businesses are left to deal solely in cash, which comes with logistical challenges and safety concerns.

"How does the state collect millions of dollars in sales tax revenue in cannabis in an all cash industry?" he said. "Businesses in California and Colorado, they're loading up their duffel bags and driving across the state to pay sales tax. It's very unsafe."