ST. LOUIS — Sharpen those pencils and get that first-day outfit ready! Back-to-school time is almost here. That also means some savings are also near. On Friday, Missouri kicks off its tax-free weekend.

But there are some catches, including what you can get, and who is participating.

Missouri Tax-Free Weekend

Missouri's 2022 tax-free weekend runs from 12:01 a.m. on Friday, Aug. 5, to Sunday, Aug. 7, according to the Missouri Department of Revenue's website. Certain back-to-school items like clothing, computers and school supplies will be exempt from sales tax.

It's important to note that cities, counties and districts can opt to not participate. That means you'd still pay the local tax, but the state tax would still be exempt.

Most of the main counties in the St. Louis metro area are participating, but a few opted out, like St. Charles and St. Genevieve.

You'll find a list of each city, county and district not participating by clicking here.

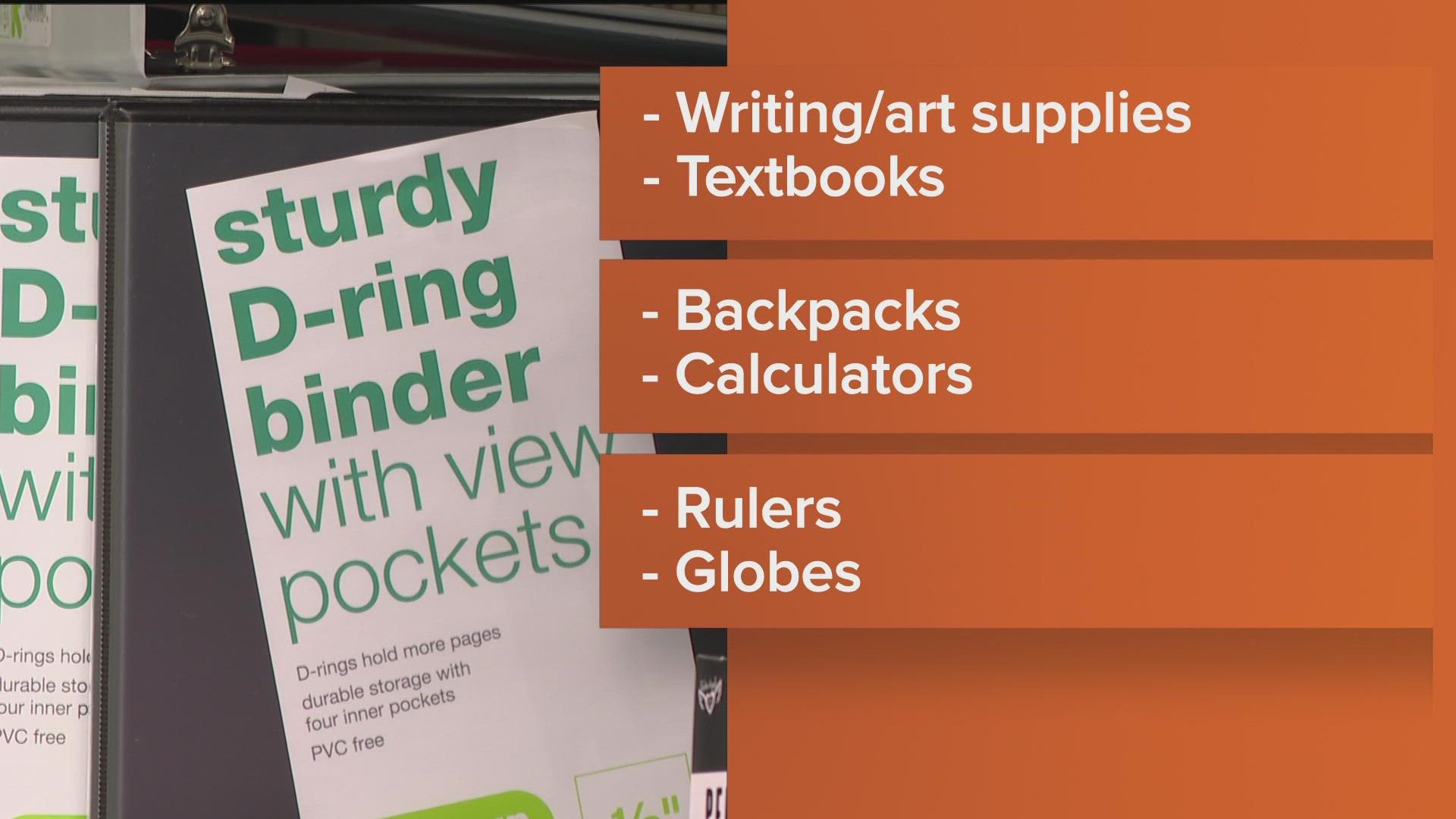

What's included in Missouri's Tax-Free Weekend?

According to the Missouri Department of Revenue's website, the following items are included in the tax-free weekend.

- Clothing – any article having a taxable value of $100 or less

- School supplies – not to exceed $50 per purchase

- Computer software – taxable value of $350 or less

- Personal computers – not to exceed $1,500

- Computer peripheral devices – not to exceed $1,500

- Graphing calculators - not to exceed $150

For a further breakdown of the definition provided by the state for each of these categories, click here.

Some items that qualify as school supplies include:

- Backpacks

- Book bags

- Crayons

- Glue

- Journals

- Lunch boxes

- Note cards

- Notebooks

- Paper

- Rubber bands

- Rulers

- Scissors

- Staplers

- Staples

- Tape

- USB flash drives

- Writing instruments

Purchases for tax-free weekend must be for personal use only, which does include teachers buying supplies for their classrooms.

For even more school supplies that the Missouri Department of Revenue says normally qualify, look at their FAQs page by clicking here. You'll also find what normally qualifies when it comes to computers and clothing.

What does not qualify?

Some examples of what does not qualify under the Missouri tax-free weekend include:

- Batteries

- Facial tissues

- Belt buckles

- Handheld media devices or iPods

- Locker mirrors

- Scarves

- Watches

- Sporting equipment

- Umbrellas

- Radios

- Handbags

- Headbands

- Headphones

These are just some of the items. For more items that normally do not qualify under Missouri's tax-free weekend, check out the FAQ page on the Missouri DOR website.

5 On Your Side spoke with parent, Melody Meiners, who said she always takes advantage of tax-free weekend, but this year with inflation, it's more important than ever.

"Anywhere that we can cut back and save is a big deal for us. Right now, we're even looking at some of those money saving apps, and while it's only like a couple percentage points' savings over the long run, it does add up, and it's nice to have a little bit of money back and to save where we can," she said.

Illinois' Tax Holiday

Illinois' Tax Holiday also starts Friday. It lasts for two weekends, running from Aug. 5 through Aug. 14. The Illinois Tax Holiday is a bit different than Missouri's Tax-Free Weekend. In Illinois, the state tax is lowered by 5% on qualifying clothing and school-related items.

For a list of qualifying and non-qualifying items during Illinois' sales tax holiday, click here.