ST. LOUIS — Some homeowners across the St. Louis area are seeing their property values rise, and that means their taxes are expected to go up too. Some St. Louis area property assessment notices are out and depending on where you live, home values could go up from 10 to 20 percent. Homeowners can appeal the assessment, just like Jan Kapp did.

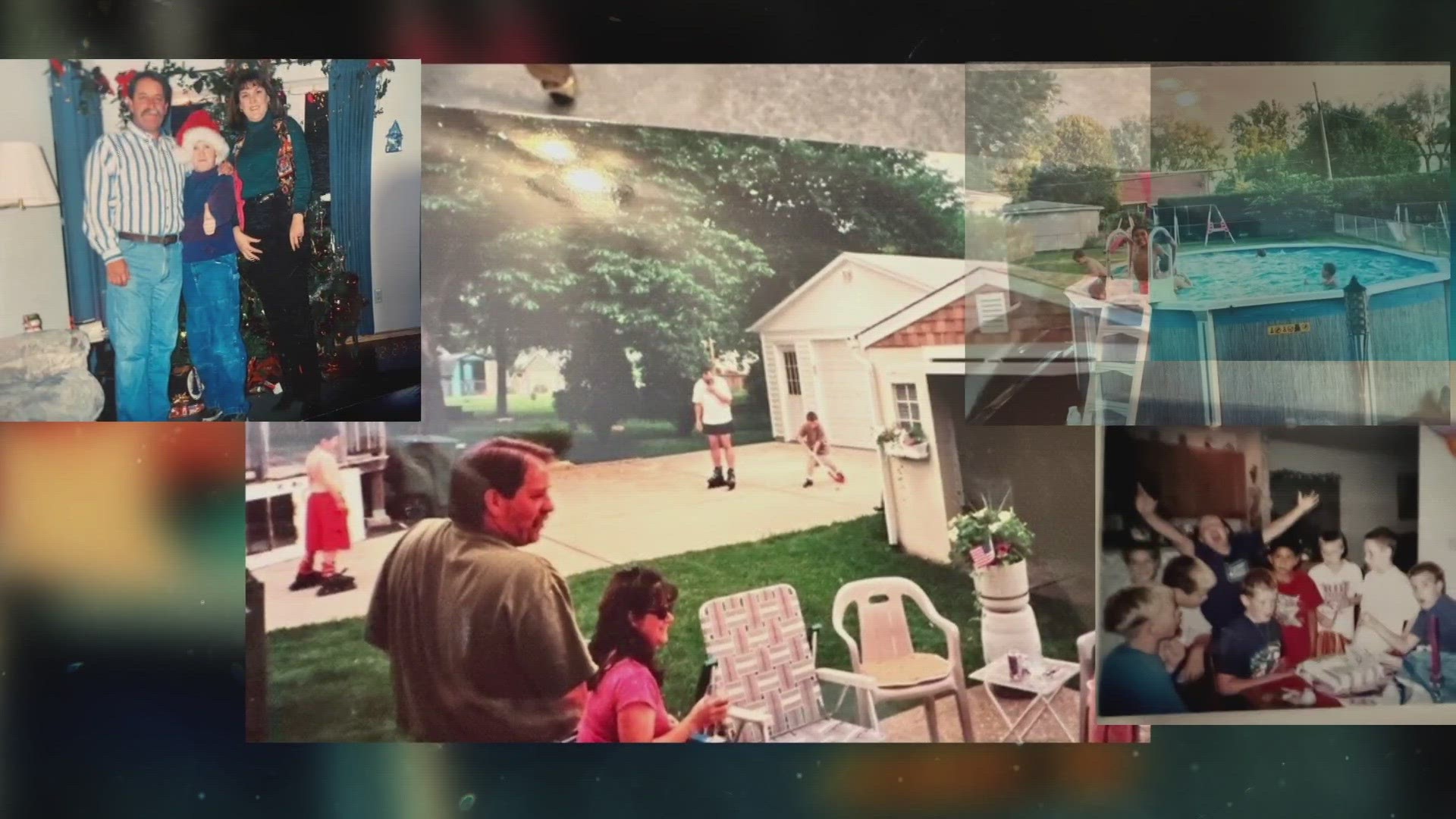

Kapp and her family have called a three-bedroom, two-story house on Bradley Avenue in St. Louis home for 28 years.

“Oh, I have tons of memories,” Kapp said. “My husband and I would throw a 4th of July party every year for all our friends and families, birthday parties and just wild, crazy times with boys.”

Five years ago, Jan noticed her property assessment going up but didn't have the energy or even know how to appeal.

“And then this year, when I opened it up, I thought, no way it can go up again,” said Kapp. “And I opened it up and sure enough, it's a couple hundred dollars more. And I thought oh no, this is not. So, I was like, I'm appealing.”

The appraised value of Jan's home went up more than $26,000.

“I had applied for a mortgage loan on this house. So, I have that appraisal and I thought, I know it's $50,000 less than what they're appraising my house at on the assessment,” Kapp said.

She started the informal appeals process with an email. While appraisals can cost several hundred dollars, realtor Holly Laws often helps homeowners who want to appeal.

“I'll do a property evaluation for you for free, which is where I look up the comps for you. And it's very easy for real estate agents,” said Laws. “And it takes us minutes because we have all that information on our computers and we can pull up those comps.”

City homeowners can gather their own information by visiting the St. Louis City Property Search website.

“If you're in the county, you'd go to the county assessor's office and in the city, you could only look them up by address,” said Laws. “So, you'd have to kind of know what houses have been for sale and see if they're the same size, same amenities and what the cost was.”

St. Louis Assessor Michael Dauphin said his office welcomes appeals. He suggests starting with the basics, like bids for work that needs to be done on your home, and pictures of problem areas. No camera? the assessor's office will send someone out to take those pictures for you free of charge.

The bottom line — appealing a property assessment doesn't have to cost a homeowner, but a little effort could save you money.

“If you're going to put $300 to $500 into an appraisal, not everybody can afford that. But you can walk around, and you can get on your phone and you can go to the city tax records and you can look up what other properties are paying for their taxes, what they paid last year or whatever. So, I think that would be a first step for regular Joes like me,” Kapp said.

She received news that the appraisal amount she provided was accepted, so her appeal is headed in the right direction. St. Louis city residents have until June 16th to make informal appeals requests.

St. Louis

There are 135,000 dwellings in St. Louis, 92,000 of those dwellings received reassessments. Notices have been mailed. St. Louis Assessor Michael Dauphin tells 5 On Your Side the average increase of property assessment value is 10 percent. Dauphin also said his office welcomes appeals from residents.

St. Louis County

Members of the St. Louis County Assessor’s office have been out looking at every single home in St. Louis County to figure out its fair market value. There’s a total of a bout 400,000 residential and commercial dwellings. Property assessment notices are expected to go out by the end of May. Residents can visit the county’s website and click on Reassessment to learn more about the appeals process.

St. Charles County

Members of St. Charles County Assessor Scott Shipman’s team looked at around 170,000 resident and commercial properties. The office has hosted three community question-and-answer sessions to give residents the opportunity to ask questions about reassessments. Informal hearings for real estate assessments will be held at the St. Charles County Election Authority, located at 397 Turner Blvd., St. Peters.

St. Clair County, IL

St. Clair County Assessor Jennifer Gomric-Minton tells 5 On Your Side ¼ of residential and commercial property is reassessed each year. Residents who have reassessment questions can call the Assessor Department in Belleville at (618)825-2704.