ST. LOUIS — A St. Louis veteran is meeting roadblocks trying to buy his first home. He believes there's so much competition, he doesn't stand a chance.

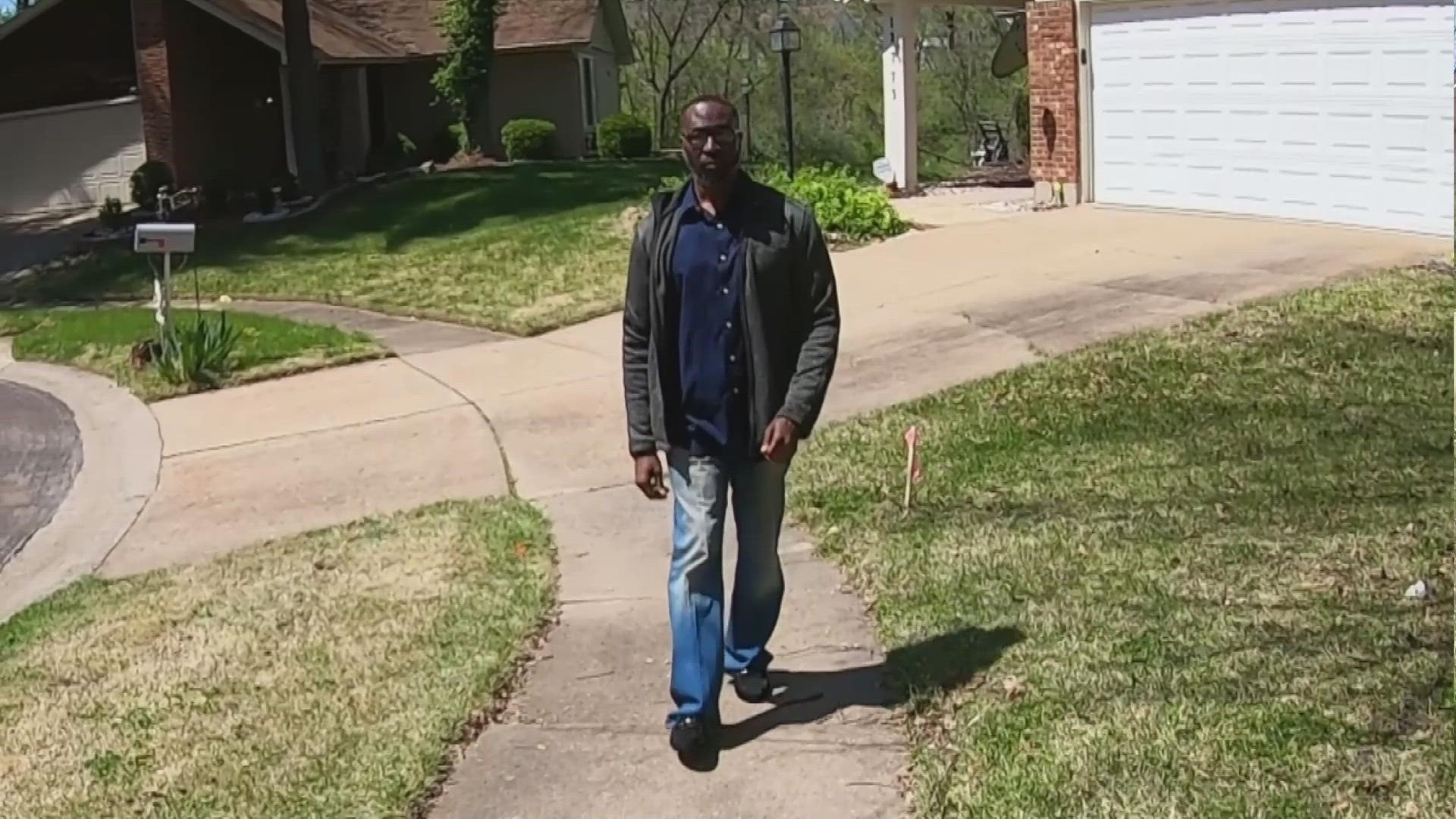

"This is my city," said Melvin White, a St. Louis native.

White has called St. Louis home for 53 years. He worked for the United States Postal Service for 20 years. He served our country.

"Proud to be a veteran of the United States Air Force," he said.

And he helps revitalize streets named after Dr. Martin Luther King through his nonprofit.

"Called Beloved Streets of America. It's a national initiative that we started right here in St. Louis."

Now, he wants to settle down with enough space for visits from his kids. His heart was set on a single-family home in north St. Louis County.

"It had a two-car garage, it had a fireplace and a finished basement."

"Was this your dream home?" asked the I-Team's Paula Vasan.

"Oh, yeah, this was it right here," White said.

His dream didn't come true.

"It kind of deflated me at that time," he said.

Even though White offered $15,000 over the asking price, it wasn't enough.

Because White is a U.S. veteran, he is working to find a home using a loan through the Veterans Benefits Administration. His realtor, Paris Friarson, said this means White doesn’t have to pay a down payment for his house.

Friarson said one of the other requirements of his federally-backed loan is that the inspection process is more time-consuming. She said White may be having an even harder time finding a house because some sellers don’t want to go through the hurdles that a federally-backed home can entail.

"It's frustrating," said White.

One of the last homes he made an offer on had a total of 28 offers. Four of them were from real estate investment companies. While the winning offer didn’t go to an investor, Friarson said investors are driving competition, especially in places like north St. Louis County.

"They are just coming in with really competitive offers," said Friarson.

She said these companies typically buy homes, renovate, and then rent them out or sell them at a profit.

"It's really hindering a lot of first-time homebuyers," she said.

5 On Your Side worked with Realtors to find how often investors are buying homes in our area.

Over the past year in St. Louis County, records we analyzed through a data aggregator show investors have bought about 28% of homes.

In parts of north St. Louis County, it’s about 45%, according to St. Louis Realtor Joe McCall and the economist team at CoreLogic, a software company that aggregates real estate data. Its data shows 400 homes went to investors in north St. Louis County in the last year instead of people like White.

Nationally, real estate investors bought a record 18.4% of the homes that were sold during the fourth quarter of 2021, according to real estate brokerage firm Redfin. This is up from 12.6% a year earlier.

Realtors said the interest in north St. Louis County among first-time homebuyers and investors makes sense. Homes in the area are generally priced lower compared to other parts of St. Louis.

Homes in north St. Louis County, where Melvin White wants to buy his first home, are increasing in value at some of the fastest rates compared to all of St. Louis.

In Jennings, homes have jumped in value year-over-year by nearly 36%. In Bellefontaine Neighbors, it’s 27%. In Spanish Lake, it’s about 24%. And that’s all above the national average of 20.6%, according to data from real estate listing website Zillow.

The I-Team contacted 18 local and national real estate investment companies for their reaction.

No one agreed to an on-camera interview. Some expressed concerns about being misrepresented. Two companies told us, in exchange for not revealing their names, that investors aren't the problem. The problem, they say, is a lack of inventory.

There was an average of nearly five offers per home sold in March 2022, according to a recent survey conducted by the National Association of Realtors. Total housing inventory at the end of March totaled 950,000 units, down 9.5% from one year ago, according to the association.

Katie Berry, board president of St. Louis Realtors, said in an email: "We want people to invest in St. Louis; investment in our region is a good thing. I know first-hand how frustrating the current market is for buyers, especially for people who are concerned they may not be able to find housing. We need more housing, and that does include rentals; and investors add to the rental market."

Berry said the problem we are facing isn't investors, but a lack of investment going back years.

"In many parts of our region we have a plethora of housing stock that is currently vacant. We need to encourage investment in those areas, we need investors to invest in currently vacant homes to create more housing stock at all levels: affordable housing, market rate, and luxury properties."

White said that investors are part of the problem of low housing inventory.

"The investors are coming in with cash offers," said White.

"Do you feel like investors are pushing you out of this market?" asked Vasan.

"Yes," said White.

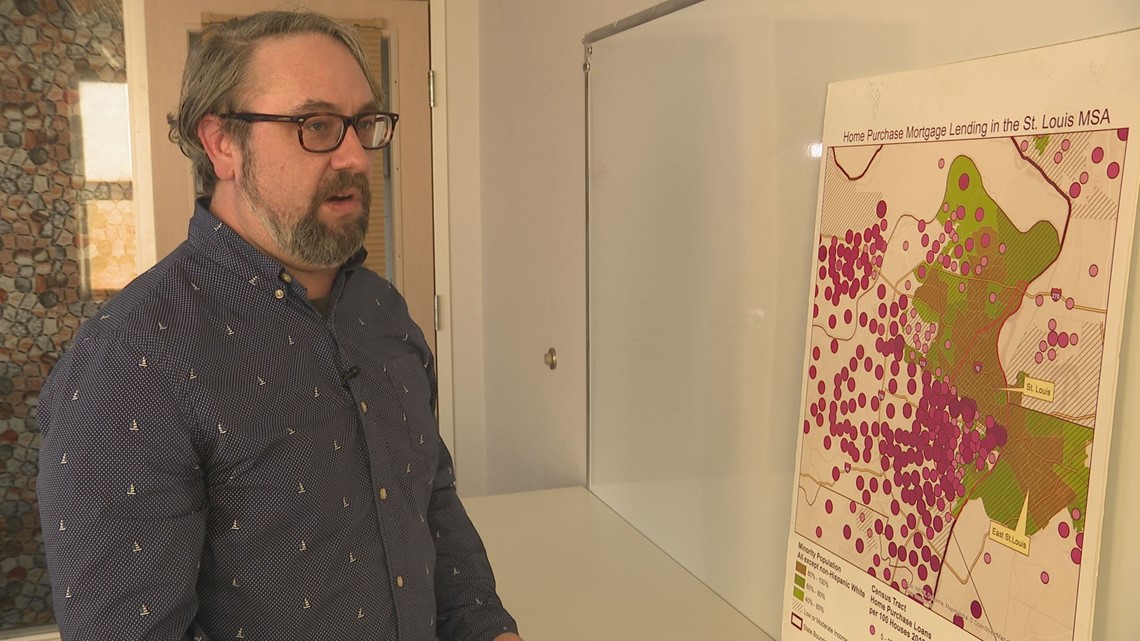

At the Metropolitan St. Louis Equal Housing and Opportunity Council, Glenn Burleigh researches what he calls a housing divide between those who profit from homeownership and those who pay their landlords.

"It's extremely concerning…" said Burleigh. "It makes me mad."

He said it's getting worse in places like north St. Louis County.

He said the data he has been analyzing reflects a lack of mortgages in the area among would-be homebuyers. Swooping in, he said, are investment companies that often don't need mortgages since they've got up-front cash.

"Something is obviously wrong if a veteran with a VA loan can't buy their first house," said Burleigh.

"What needs to change to give people like Melvin White a fighting chance at owning a home?" asked Vasan.

"Could be something changed where these investor groups have to wait a certain amount of time after listing," he said.

Without regulatory change, Burleigh said people like White will keep losing out.

“We've been at it for three months straight," said White.

White said he is determined to get his American Dream.

"I'm not going to lose hope now," he said.