ST. LOUIS — Your wallet will surely feel the effects of inflation this year when back-to-school shopping.

The average U.S. household is expected to spend about $890 on school supplies in 2023, according to the National Retail Federation. That’s a record high and $25 more than last year. And households with college students are expected to spend about $1,367 per student, up from about $1,200 last year.

Strategically shopping for school essentials during sales or tax-free events can help you save a few bucks.

Here’s everything you need to know about sales tax holidays in Missouri and Illinois.

When is Illinois’ back-to-school sales tax holiday?

Illinois will not have a sales tax holiday for school supplies this year.

When is Missouri’s back-to-school sales tax holiday?

In Missouri, the back-to-school sales tax holiday will begin at 12:01 a.m. Aug. 4 and end at 11:59 p.m. Aug. 6. All qualifying purchases made in-store or online during this time will be exempt from all state and local sales taxes.

During this tax holiday, you could save even more on school supplies than years prior. A state law that went into effect this year prevents cities, counties and special tax districts from charging local sales tax. Previously, localities could choose whether to participate.

You don't have to be a Missouri resident to take advantage of the state's sales tax holiday, so Illinois shoppers who make the trip across the Mississippi River to make purchases can still save.

What school supplies are exempt from sales taxes?

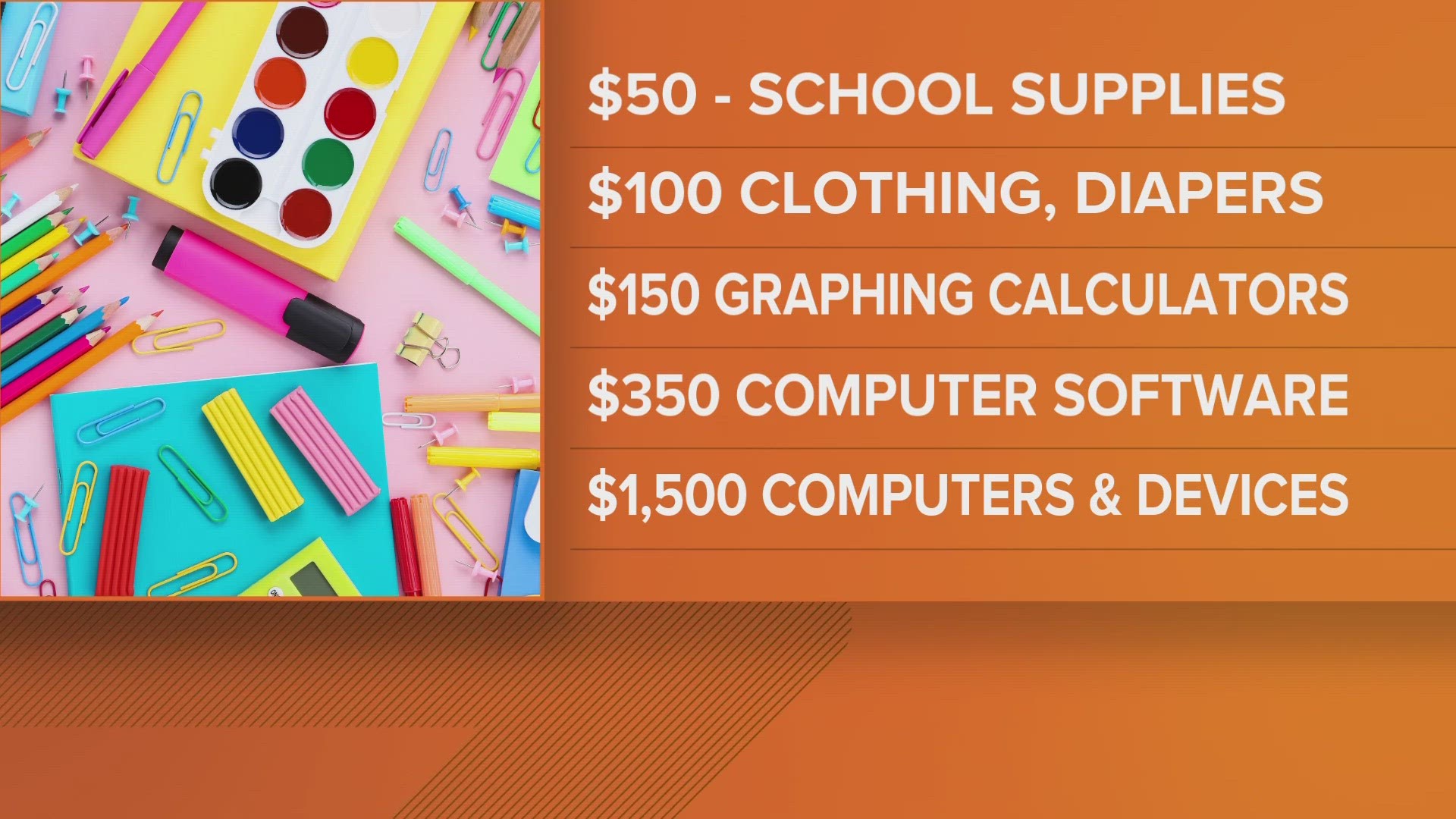

The sales tax exemption applies only to the following items:

- Clothing with a taxable value of $100 or less

- School supplies not exceeding $50 per purchase

- Computer software with a taxable value of $350 or less

- Personal computers not exceeding $1,500

- Computer peripheral devices (such as keyboards, printers, microphones and monitors) not exceeding $1,500

- Graphing calculators not exceeding $150

What qualifies as school supplies?

- Art supplies

- Backpacks

- Globes

- Handheld calculators

- Lunch boxes

- Maps

- Journals

- Paper

- Textbooks

- USB flash drives

- Musical instruments

- Padlocks

- Paper

What does not qualify as school supplies?

- Watches

- Radios

- CD players

- Sporting equipment

- Cell phones

- Office equipment

- Furniture

- Headphones

What qualifies as tax-exempt clothing?

- Diapers

- Shoes

- Materials used to make school uniforms

- Shirts

- Pants

- Jackets

What does not qualify as tax-exempt clothing?

- Jewelry

- Watches and watchbands

- Scarves

- Handkerchiefs

- Ties

- Handbags

- Umbrellas

- Headbands

- Belt buckles

For more information about what items qualify for the sales tax holiday in Missouri, click here.

To watch 5 On Your Side broadcasts or reports 24/7, 5 On Your Side is always streaming on 5+. Download for free on Roku or Amazon Fire TV.