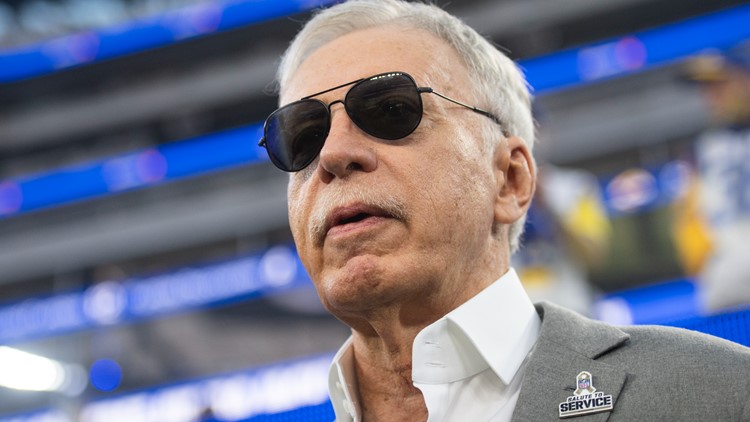

ST. LOUIS — Stan Kroenke and his wife, Ann Walton Kroenke, are among the 400 top income earners in the U.S., according to IRS files obtained and analyzed by nonprofit news organization ProPublica.

He has built a real estate and sports empire, which includes ownership of the Denver Nuggets, Colorado Avalanche and the NFL team he moved out of St. Louis, the Los Angeles Rams. She is an heiress to the Walmart fortune.

Ranked at No. 305 among the 400 highest earners, their average annual income was $131 million from 2013 to 2018, according to an analysis this week by ProPublica. The Kroenkes paid an average effective federal income tax rate of 14% in the period, with 100% of their income taxed at a lower rate (based on their highest income year during the period) and 30% of their income deducted, according to the organization.

Well-represented on the list are heirs of large fortunes: There are 11 heirs of Walmart founders Sam and Bud Walton on the list, including Ann Walton Kroenke and her husband, Stan.

In comparison to those on the top 400 earners list, the annual income of the typical American is $40,000, with the top 5% earning at least $198,000 (comparable to a primary care doctor's salary) or at least $485,000 to crack the top 1% (such as a successful law firm partner's income), according to the nonprofit.

To appear on ProPublica's list of the top 400 U.S. earners, each had to make an average of $110 million annually. Most billionaires didn't come close to appearing in the top 400 earners. Some use write-offs to eliminate taxable income, while others, such as Berkshire Hathaway CEO Warren Buffett (who had an average annual income of $27 million from 2013-2018) avoid income as their wealth rises. One tactic often used by billionaires to avoid taxes is to borrow against their wealth, according to ProPublica.

While the effective income tax rate paid climbs as incomes rise into the top 1%, the trend stops when individuals get into the $2 million to $5 million range, and drop again once incomes climb higher, according to the nonprofit. This is because income from financial assets, such as that among the top 400 earners, is generally taxed at a lower rate.

Average effective income tax rates from the 2013-2018 period analyzed, according to IRS data, were:

- 5% for $40,000-$50,000 income

- 19% for $200,000-$500,000 income

- 29% for $2 million to $5 million income

- 27% for $12 million to 458 million income

- 22% for those in the 400 top income earners in the U.S. during the period.

So with their average effective income tax rate of 14%, the Kroenkes appear to have paid even less than the average of those on the top 400 earners list. (Stan Kroenke's net worth is $10.7 billion and Ann Walton Kroenke is worth $9 billion, according to Forbes' 2022 ranking of the richest people in the world.)

Combined, the 400 top U.S. income earners, according to ProPublica's analysis, saved an average of $1.9 billion in taxes each year during the period analyzed, due to the lower rate on dividends.

Heirs typically received their income from dividends or other investments produced by their inheritances. The 11 Walmart heirs ranked in the top 400 saved $371 million annually due to the lower long-term capital gains rate having been extended to most stock dividends starting in 2003, the analysis says.

Read the rest of this story on the St. Louis Business Journal's website.