WENTZVILLE, Mo. — Homeowners in Wentzville are fixing the damage left behind from Tuesday's storm.

Hail and wind ruined siding and roofs in western St. Charles County.

State Farm has deemed this a catastrophic claim and reports a total of almost 1,500 auto and home claims, with the highest claim concentration in the city of Wentzville.

State Farm reports a large majority of these claims are related to hail, with a handful reporting damage from wind.

Co-owner Donnie Welker is with local company 3 Brothers Gutters & More.

Welker said on Thursday, that they were already working with 65 to 70 homeowners inspecting roofs and siding, but they expect 250 total.

On average, it's looking like $25,000-$30,000 in damage per home. Welker noted this is a case-by-case situation.

Mayor Nick Guccione recommended that residents hire local and be wary of potential scammers in the area.

"These are the storm chasers I call them, they call and inspect the roof, sometimes they don't have any credentials," Guccione said.

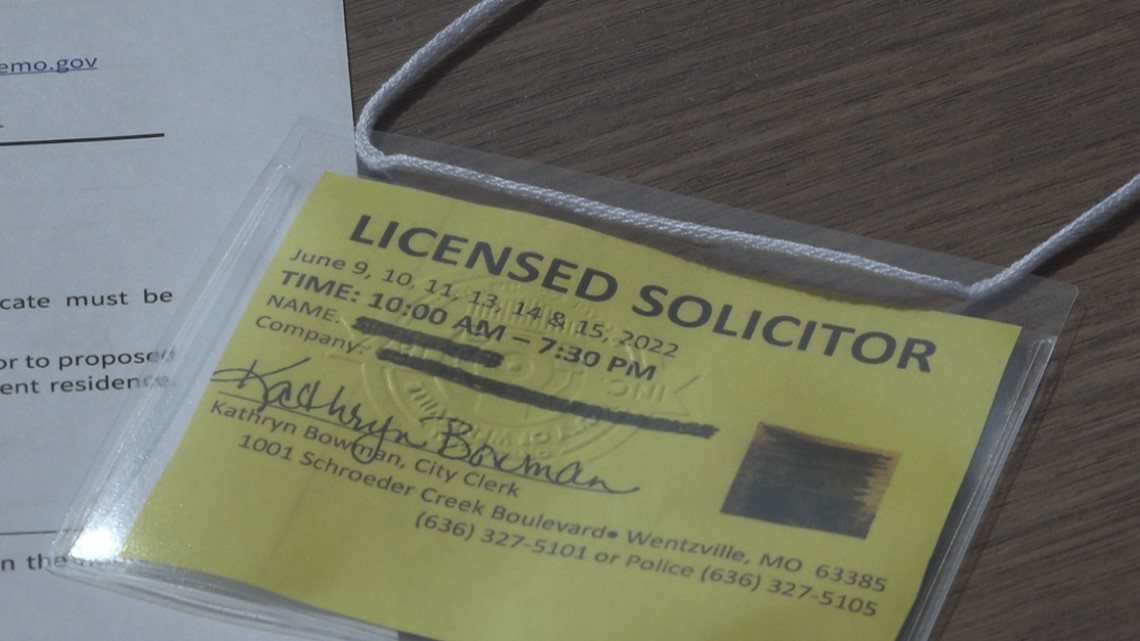

City Clerk Kathryn Bowman explained there's a process in place.

The city of Wentzville licenses solicitor badges.

Usually, the process takes three to five days, but Bowman said they would expedite the process.

There are fees and a checklist to fill out.

"This keeps our residents safe, so they know they've gone through a background check. The solicitor is approved by the city and would have a yellow badge to wear around their neck," Bowman shared.

Bowman noted door knocking should not be happening, but contractors can hang tags on doors. He said there are exceptions.

"If a resident comes out and talks to them, that's OK. If a contractor is unlicensed (with a badge) and they are just at your neighbor's house processing their damage and you say 'can you come over here?' then that's okay," Bowman said

Guccione also said these stickers are available at city hall or the police department.

The Better Business Bureau has a warning for Wentzville.

"Some red flags are contractors reaching out to you. Another thing if they are asking for cash-only deals, using high-pressure tactics and high upfront payments," Sarah Wetzel with BBB said.

Wetzel reminds consumers to not make quick decisions and to do research.

Here are BBB tips to consider when hiring contractors for emergency work:

- Call your insurance company first. Contact your insurance company to determine what coverage will be provided and if there are any restrictions or conditions before finalizing a contract with a repair service.

- Research the company. You can search for a contractor’s BBB Business Profile to learn if it’s a BBB Accredited Business, see complaints and read customer reviews. Ask for local references and speak with those customers about their experience and the quality of the work.

- Watch out for red flags. Be cautious any time a contractor contacts you first, especially after a natural disaster. Avoid cash-only deals, high-pressure sales tactics, high up-front payments and making any payments without a written contract.

- Shop around. Ask for quotes from multiple businesses for the same criteria and aim for three bids. The lowest bid may not necessarily be the best bid; if one bid is significantly lower than the others, the contractor may be cutting corners or may not understand your work requirements.

- Get it in writing. Request a detailed, written contract. Do not be pressured into signing an agreement before you are ready, and make sure you read and understand it before signing. The contract should include contact information, start and complete dates, a detailed description of the work to be done, material costs, payment arrangements and warranty information.

- Verify license and insurance. Confirm that the company you decide to work with has the necessary licenses and insurance to work in your region.

- Ask about a lien waiver. A lien waiver is a statement from your contractor that says all suppliers and subcontractors have been paid for their work.

- Arrange a payment schedule. For major jobs, never pay in full upfront. Stagger your payments so your final payment is not due until the work is complete and you have fully inspected it. Do not pay with cash; use a credit card if possible.

- Get a receipt. Request a receipt marked “Paid in Full” when the job is completed and your final payment is made.

- Keep your contract. Hold on to your contract for future reference or if any questions arise after the work is complete.

State Farm also shared this information when filing a claim:

Vehicles:

Any vehicle left outdoors during a storm is susceptible to damage. Here are some common signs of hail damage:

- Large or small dents in the hood, doors, side panels or trunk; these dings typically aren't uniform, may not damage the paint and may not cover the entire vehicle

- Chipped, cracked or broken windshield, windows or mirrors

- Water damage inside the vehicle due to broken glass components

- Missing or loose side mirrors

- Doors or side mirrors that are stuck or jammed

Homes:

Clean-up/recovery and claims process:

- Begin to look for damage around your home and take photos.

- Look for shingles in your yard, water stains on your highest ceiling, and damages to downspouts and gutters.

- Document your damage with pictures.

- If you need to, make temporary repairs to roofs with tarps or board up broken windows to prevent more damage.

- Save the receipts related to the temporary repairs to file for potential reimbursement.

- Don’t discard or repair anything prior to reporting the claim.

- Don't have any permanent repair work done until you discuss your situation with your claim representative.

State Farm has several options, including filing on its website or calling 1-800-SF-Claim(1-800-732-5246).